Business

Tencent’s Universal Music Group acquisition is now official

After signing the paperwork back in December, the €3bn deal for a 10% stake has now closed.

Published

4 years agoon

Story Highlights

- The stake was purchased for €3million back in December.

- Tencent has an option to acquire an additional 10% between now and January 2021.

Three months after signing and announcing the agreement, Chinese tech conglomerate Tencent have finalized their deal to purchase a 10% stake in Universal Music Group. The share was purchased at €3billion ($3.37bn), valuing UMG at €30million ($33.7bn). As well as now being a minority holder of Universal, Tencent (for those who don’t already know) is a majority shareholder of Tencent Music Entertainment – a subdivision co-owned by Spotify that houses music streaming apps QQ Music, Kugou, and Kuwo. Combined, these streaming platforms have over 700m actively monthly users, with 120m paying subscribers.

Back when the Tencent-Universal deal was announced last summer, trade body IMPALA formally opposed the deal – claiming that “the risk of harm for consumers and competitors from such a transaction would be a concern“.

Nonetheless, it has now closed – and also includes an option for Tencent to acquire a further 10% between now and January 2021, based on the same valuation and exchange rate.

In a statement discussing details of the purchase, Vivendi (parent of UMG) said: “Vivendi is very happy with the arrival of the Tencent-led consortium. It will enable UMG to further develop in the Asian market”.

Vivendi is very happy with the arrival of the Tencent-led consortium. It will enable UMG to further develop in the Asian market

Vivendi Tweet

This comes off the back of statements made by the the French media giant in July 2018 – when they announced plans for an IPO. Ultimately, those plans were scrapped, but have since been revived with the idea to instead only offer a portion of the company’s stock for public offering. The IPO scheduled to go live over the next three years.

Additionally, the music major-parent intend to sell more minority stakes following this Tencent deal. The company said the following: “Now that this very significant strategic operation has been completed, Vivendi will pursue the possible sale of additional minority interests in UMG, assisted by several banks which it has mandated“.

MBN Staff

Business

$500m of Live Nation stock was just purchased by Saudi Arabia

The Kingdom of Saudi Arabia bought 12,337,569 shares in Live Nation Entertainment, according to an SEC filing.

Published

4 years agoon

Monday, 27 April 2020 @ 16:19 EDT

Story Highlights

- The Kingdom of Saudi Arabia bought 12,337,569 shares in Live Nation Entertainment.

- Saudi are now the third largest shareholder of the live music giant.

In an opportunistic move, the Kingdom of Saudi Arabia has purchased over $500million worth of Live Nation Entertainment shares on the New York Stock Exchange (NYSE). Amongst other media conglomerates, Live Nation has seen a big dip in stock value amid COVID-19. After closing out at $76.08 on February 19, company stocks have closed at as low as low as $25.50 within the past two months – reaching an 52-week low of $21.70. However, after the half-a-billion dollar transaction by the middle eastern nation was revealed in a SEC filing today, value for the company shot up by 15% (at the time of writing).

As a result of this major purchase, Saudi Arabia now owns 5.7% of Live Nation Entertainment – holding the title of the third largest shareholder of the company. To be precise, that is a whopping 12,337,569 shares.

Music Biz Nation previously reported on the impact COVID-19 has had on the Live Music Industry, and specifically, Live Nation. Due to a widespread cancelation of concerts for the remainder of the year, LNE shares have been down around 40% since this time last year.

Company CEO Michael Rapiro announced he will be forfeiting his 2020 salary, and a number of senior Live Nation executives will be taking up to 50% pay deductions to compensate for loss of income occurred by the cancelations.

Prior to COVID-19, the Live Music Industry was set to see a record-breaking year in 2020 – but may instead incur potential losses of up to $9billion. With the year-on-year growth the industry has been experiencing over recent years (as reported by Pollstar), it is likely the demand for concert tours will see an unprecedented demand once the coronavirus pandemic has settled, globally. This, of course, creates a perfect opportunity for investors – that Saudi Arabia has capitalized on.

According to reports, Saudi’s Public Investment Fund has made a number of investments during the COVID-19 period, including oil companies – though this has not been confirmed.

Due to the strict islamic culture of Saudi Arabia, this $500million purchase of LNE shares raises questions about the country’s overall interest in entertainment. Due to some of their restrictions – which have been protested by Women’s Rights and LGBGTQ Activists, many artists have avoided performing in the region. Nicki Minaj famously turned down an offer to perform at Jeddah World Fest in Jeddah (Saudi’s second largest city) last year.

Time will tell if this buy was strictly an economic move – or one to boost tourism, which has been a focus of Crown Prince Mohammed bin Salman since he took office.

Get weekly music biz updates straight to your inbox.

MBN Staff

Analysis

Twinkie Clark’s publishing catalog worth millions, says Attorney

Twinkie’s songwriter journey was recently depicted in Lifetime TV Biopic ‘The Clark Sisters: First Ladies of Gospel’.

Published

4 years agoon

Wednesday, 22 April 2020 @ 17:58 EDT

Story Highlights

- The Clark Sisters’ story was recently depicted in a Lifetime movie biopic.

- Attorney James L. Walker, Jr. recaptured Twinkie Clark’s publishing rights after she sold her catalog for a car.

Gospel Music Legends The Clark Sisters have recently seen a huge resurgence in interest and popularity. On April 11, the faith-based music icons saw their story told in more detail than it has ever been – as their first biopic ‘The Clark Sisters: First Ladies of Gospel’ aired on Lifetime TV. Produced by Dr. Holly Carter (alongside Grammy Award Winning Artists Mary J. Blige, Missy Elliott and Queen Latifah) – the initial broadcast captured an audience of a 2.7 million, and closed out with 11 million total (after repeat airs and DVR ratings came in).

The movie told the lives of sisters Denise, Jacky, Elbernita (otherwise known as Twinkie), Dorinda and Karen – their rise to fame, and everything in between. One of the highlights, from a music business perspective, was the sale of Twinkie’s publishing catalog.

It is unknown exactly how accurate the Lifetime movie depiction was, as a number of scenes have been disputed by Larry Clark (son of Denise) and Twinkie’s former husband Johnny Terrrell. However, with the Clarks themselves being listed as Producers – and Executive Producer Dr. Holly Carter already having a working relationship with the family – one can assume most of the events were not too far from the truth.

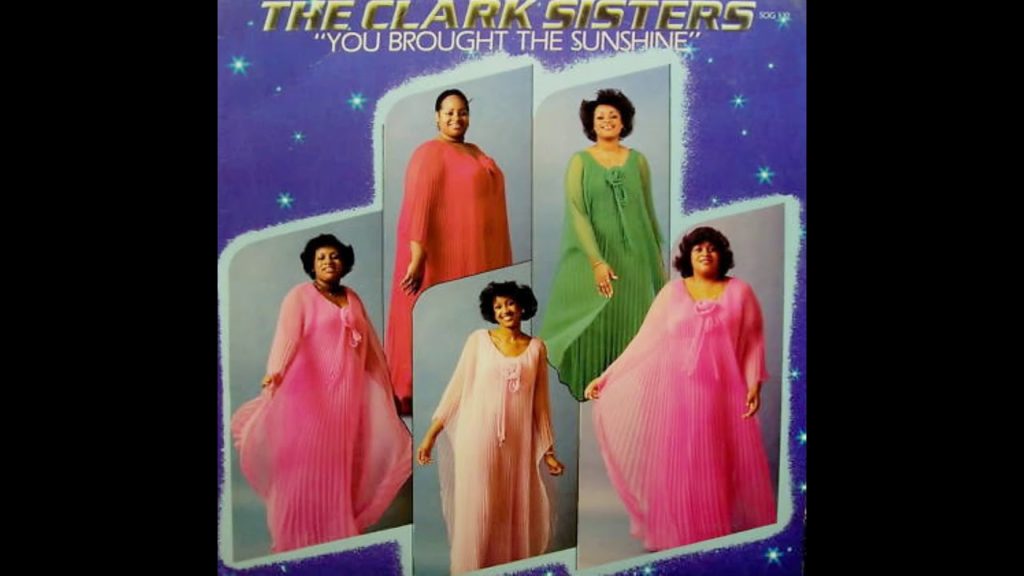

During their earlier days, Twinkie was the sole songwriter for The Clark Sisters – penning several hit songs for the group. The biggest of these was ‘You Brought The Sunshine’ – from the 1981 album of the same name. The single became a crossover hit, landing a Top 20 Spot on Billboard’s R&B Charts and a Top 30 spot on its Dance Club Songs listing.

It has been claimed that the single and album achieved a Gold certification – for sales in the excess of 500,000. Music Biz Nation was unable to verify either claim using the RIAA database – which lists U.S. gold and platinum certifications awarded as far back as 1958. We did, however, reach out to RIAA for comment, but had not heard back at the time of writing. At present, we can verify that the single had sold at least 200,000 within the two years following its release, according to a 1985 article in Billboard Magazine.

At some point during this era, according to the movie – Twinkie sold her publishing catalog to Michigan-based Bridgeport Music (which was given a fictitious name in the film) in exchange for a Lincoln Continental. Of course, the car selected for the scene may have not been the exact same as what was exchanged in the actual deal. However, if we are to assume it was of similar luxury status – that particular vehicle retailed for around $24,000 in 1979 – close to the time when Twinkie made the deal. In today’s money, that would be equal to $85,000.

The interesting part is, according to a calculated estimation by Music Biz Nation, the success of “You Brought The Sunshine” possibly made Twinkie’s catalog worth at least $400,000 to $450,000 from that release alone – more than 5x what it was sold for. It was later worth ‘millions’.

...artists and songwriters have lost millions of dollars by giving up their publishing

James L. Walker, Jr., Esq.

Music Biz Nation spoke with James L. Walker, Esq. – the Atlanta-based Entertainment Attorney who worked with Twinkie to recapture her rights five years ago. Walker was not working Twinkie when she initially sold her catalog, but did say that “generally speaking artists and songwriters have lost millions of dollars by giving up their publishing“.

When discussing the amount of publishing money made from record sales, Walker shared that “one song on a gold album is worth about $50,000“. Meaning, if it is true that the 8-song ‘You Brought The Sunshine’ album did achieve Gold status, Twinkie’s catalog on that release would have been worth $400,000 from record sales alone. This does not include additional income generated from the success of the lead single.

We also discussed the impact of the radio success and other types of revenue. Walker stated that “a hit song is worth well over a millions dollars, if it’s promoted right“. MBN asked if he would place “You Brought The Sunshine” (single) in that category – to which Walker confidently responded “oh, yes“.

Later in the conversation, Walker was asked how he was able to get Twinkie’s rights back. He shared: “There’s what we call ‘the copyright act’, and with the copyright act the writer is allowed to reclaim their rights in the 35th year of the assignment“.

The world of publishing in gospel music slightly differs to that in the mainstream. Being a niche genre, gospel generally does not generate nearly as much as pop or hip hop music in revenue. To give context, it often takes less than 5,000 equivalent albums sales to land a #1 on Billboard’s Top Gospel Albums Chart. Grammy-nominated Artist Travis Greene topped the list last November, shifting just 3,000 units.

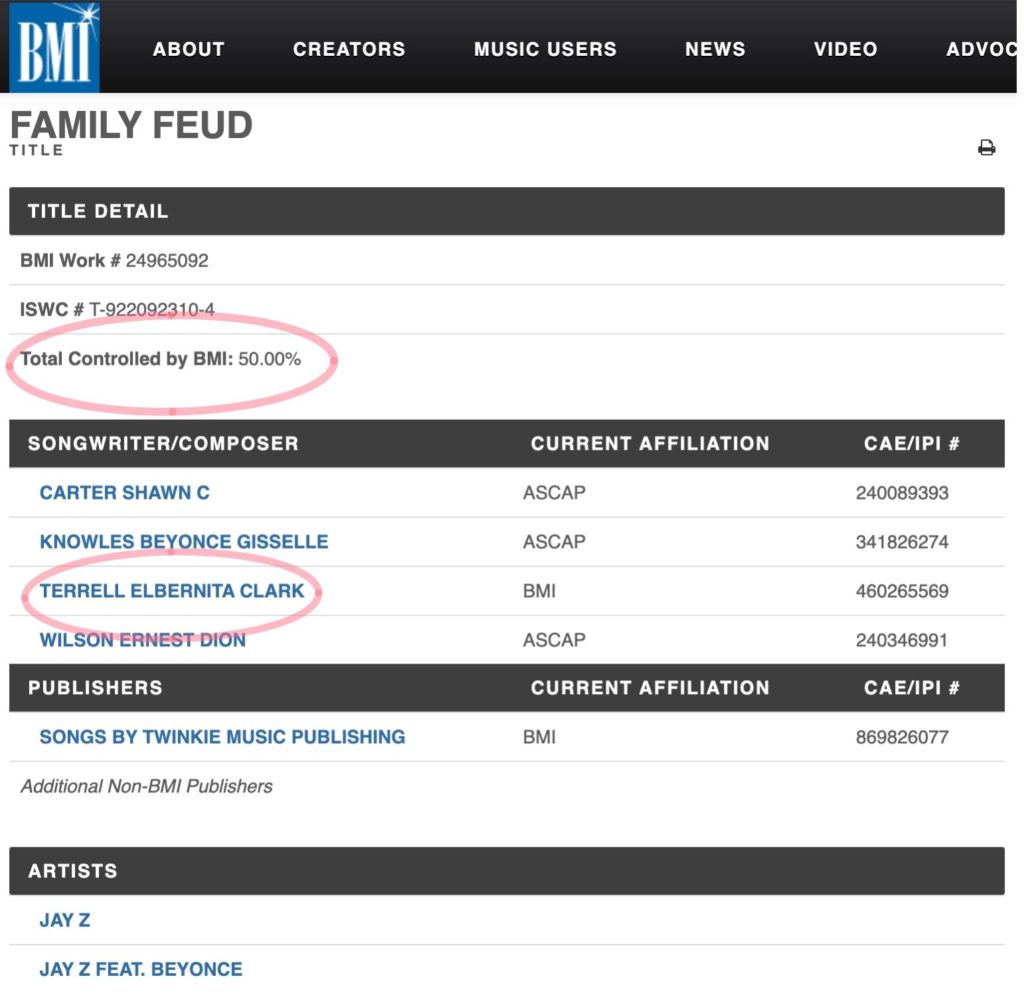

Though sales may not be where the money is at for the faith-based genre, Walker stated that ‘sampling’ is another income stream for many of its artists. Referring to Gospel Acts, he said: “Their music is used – people sample it. Jay Z sampled Twinkie’s song“.

Because Twinkie now owns her rights, she was able to claim 50% of publishing revenue when Jay-Z sampled her composition on his 2017 single release ‘Family Feud’. This 50% meant Twinkie owns a bigger share and made more publishing money from the record than lead artist Jay Z himself (and co-writer Beyonce, combined).

Outside of this example, Gospel Music has had a solid history of being sampled by mainstream artists. In the past year alone, Mary Mary’s most popular hit “Shackles” (a UK Top 10 and US Top 40) was sampled by BRIT Award Winning Rapper Stormzy on his UK #1 album “Heavy Is The Head”, and most recently by Lecrae and YK Osiris. Kirk Franklin was also sampled on Daniel Caeser’s ‘Freudian’ album.

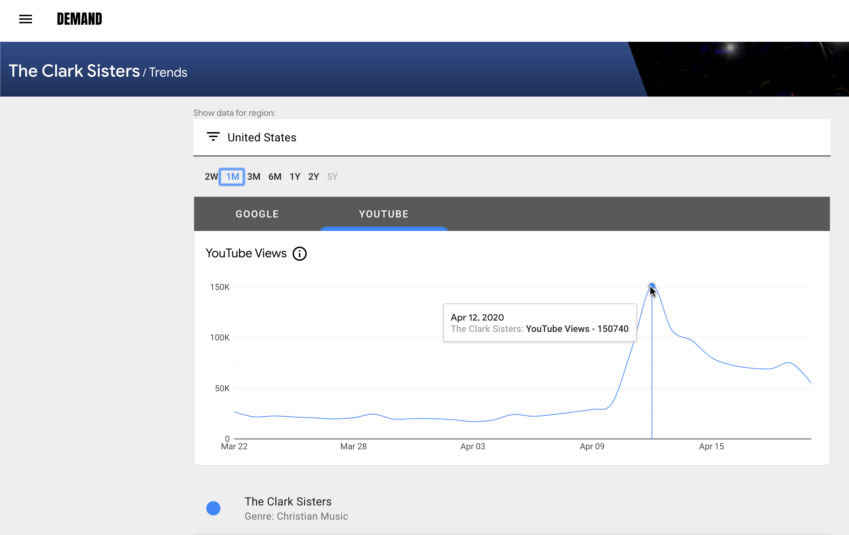

Twinkie Clark now owning the rights to her work with The Clark Sisters means she will also receive revenue from her songs being used the Lifetime Biopic. The day following the premiere, the sisters received the largest amount of daily YouTube views since at least 2018.

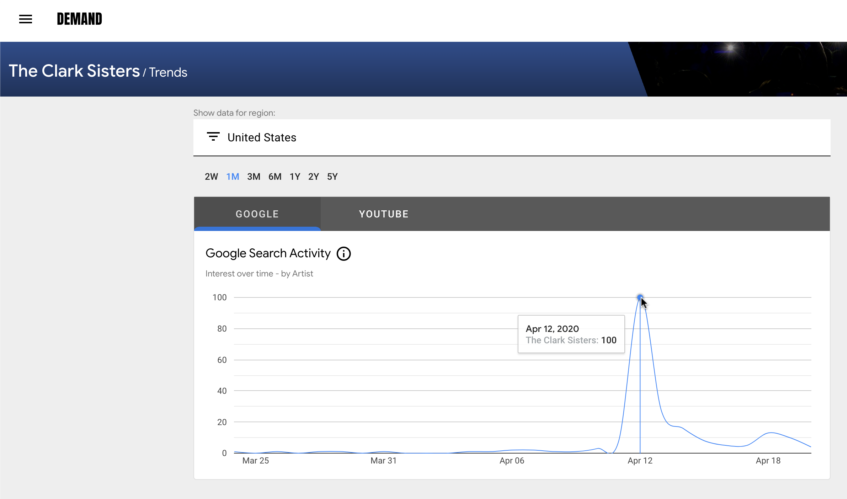

There was also a huge spike in google searches for tickets to see them live, according to Music Industry Platform ‘DEMAND’.

The Clark Sisters’ latest release ‘The Return’ was released on March 13, 2020.

Get weekly music biz updates straight to your inbox.

Ryan J. Bruce

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Albums Chart Data: Swift & Eilish Dominate UK & US Listings