News

Sony Music Group Issues Stern Warning to AI Companies Over Unauthorized Use of Content

Major label sends legal notices to hundreds of AI developers and streaming services, asserting IP rights and demanding compliance.

Published

2 months agoon

Story Highlights

In the notices, Sony demands a detailed accounting of any content used by AI firms.

Sony Music Group (SMG) has taken a decisive stand against the unauthorized use of its intellectual property by artificial intelligence companies. The major record label has issued formal legal notices to approximately 700 AI developers and music streaming services, unequivocally prohibiting them from using Sony-owned music, lyrics, or other content to train AI models without express permission.

According to the LA Times, the letter directly accuses some AI companies of potentially infringing on SMG’s intellectual property rights: “Due to the nature of your operations and published information about your AI systems, we have reason to believe that you and/or your affiliates may already have made unauthorized uses (including TDM [text and data mining]) of SMG Content in relation to the training, development or commercialization of AI systems.”

The letter suggests that Sony has grounds to believe that certain AI startups may have already been using its content to train their models without obtaining the necessary licenses or permissions – a practice the label is now explicitly challenging.

SMG Requires Detailed Accounting, Asserts Broad IP Rights

In the notices sent to AI companies, Sony is demanding a comprehensive accounting of any SMG content used in the development or training of their AI systems, insisting on a detailed breakdown of how its intellectual property was “accessed and/or reproduced and/or extracted” by the AI firms or any third-party contractors working on their behalf.

Furthermore, SMG is asserting its intellectual property rights across a broad range of content types. The company has prominently posted a “Declaration of AI Training Opt-Out” on its corporate website, unambiguously stating that it “expressly prohibits and opts out of any text or data mining, web scraping or similar reproductions” of its content – including music recordings, compositions, lyrics, artwork, and metadata – for the purpose of training or developing AI systems.

Sources familiar with the matter also disclosed to MBN that Sony is concurrently pressuring music streaming platforms to revise their terms of service, adding explicit prohibitions against the mining of Sony content for AI training purposes.

Sony Points to EU AI Act, Expresses Concern Over Potential Exploitation of Artists

Sony’s aggressive action comes in the context of the recently-passed EU AI Act, which mandates that AI developers publicly disclose the content used to train their models. However, the label’s motivations appear to extend beyond mere regulatory compliance. SMG’s public statements suggest a deep concern about the potential for AI technologies to exploit and devalue the work of the artists it represents.

“Evolutions in technology have frequently shifted the course of creative industries,” SMG declared in a statement posted on its website. “However, that innovation must ensure that songwriters’ and recording artists’ rights, including copyrights, are respected.

The label’s position is unambiguous: while it recognizes the transformative potential of AI, it will not tolerate the erosion of its artists’ rights and livelihoods in the process. Sony maintains that the unauthorized use of SMG content “deprives SMG Companies and SMG Talent of control over and appropriate compensation for the uses of SMG Content, conflicts with the normal exploitation of those works, unreasonably prejudices our legitimate interests, and infringes our intellectual property and other rights.”

In essence, Sony is putting AI companies on notice that the use of its content to power AI systems will require formal licensing agreements that ensure artists and rights holders are properly compensated. Failure to comply will likely invite legal challenges from the label’s IP attorneys.

The Intensifying Conflict Between the Music Industry and AI Sector

Sony’s stance represents a significant escalation in the simmering tensions between the music industry and AI companies over the use of copyrighted content to train generative AI models. As these AI systems grow more advanced and gain widespread adoption, music industry stakeholders continue to confront complex questions around artistic consent, fair compensation, and the very nature of creative integrity in an era of artificial intelligence.

The industry’s concerns are not merely hypothetical. Some artists and labels have already pursued legal action against AI firms alleged to have trained their models on copyrighted works without permission. Just last month, Warner Music Group CEO Robert Kyncl appeared before the U.S. Congress to advocate for legislation that would safeguard against unauthorized deepfakes and the misappropriation of artists’ likenesses.

Moreover, a coalition of over 200 prominent recording artists, including A-list acts like Billie Eilish, Sam Smith, and Nicki Minaj, recently published an open letter calling on AI companies to make a public commitment not to use their works in ways that would “undermine or replace” human artistry.

As the AI revolution continues to unfold, the music industry appears increasingly resolute in its determination to defend the rights and economic interests of creators. With influential players like Sony now directly confronting the AI sector, the battle lines are becoming more starkly defined. However, in a rapidly-evolving landscape where the boundaries between human ingenuity and machine learning are increasingly blurred, finding an equitable balance that respects the rights of creators while welcoming technological innovation may prove to be a formidable challenge.

Get weekly music biz updates straight to your inbox.

MBN Staff

Analysis

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

MBN Exclusive: New Soundcharts Data Shows The Cogs Working Behind Rap’s Hottest War.

Published

2 months agoon

Thursday, 6 June 2024 @ 20:51 EDT

Story Highlights

New data provides unprecedented insight into the underlying methodology of the Drake-Kendrick feud crucial to understanding the broader battle for hip-hop supremacy.

Few rivalries in the high-stakes world of hip hop superstardom have captured the cultural zeitgeist as completely as the recent feud between ‘Rap Gods’ Drake and Kendrick Lamar. Being two of the genre’s OGs, their every move sent reverberations through the music industry and beyond. A lot of the conversation around the ‘slugfest’ revolved around the surface-level spectacle of the diss tracks and opinions among fans, but the real narrative that shapes this feud is the one presented in the data (the streaming numbers, radio spins and listener trends that provide an insight into the way the two superstars’ strategies prior to the ‘war of words’ helped them to navigate this war behind the scenes.

A Geographic Dividend

As we previously reported at Music Biz Nation, data from Luminate – a premier music analytics company – showed an slight difference in how Drake and Kendrick diss tracks were being consumed regionally versus internationally in comparison to their overall catalogs. In Kendrick’s case, American listeners were responsible for 62.2% of streams on his Drake diss tracks, 11.5% above his typical 50.7% U.S. share. Meanwhile, Drake saw only a small boost in U.S. streams for his Kendrick disses, bumping from 58.9% to 60.1% – with the remainder coming from international markets.

Getting more specific, Kendrick’s top listenership on Spotify stems from Los Angeles (also his top radio market), London and Chicago (all seeing a 2-3% monthly increase in the past month). Drake still comfortably maintained an 82.5 million to Kendrick’s 78 million in Spotify monthly listeners over the past 28 days, with his top markets on the platform being London, Los Angeles, and New York. Notably, Drake saw a 1-2% dip in listenership in all three of his top markets, while Kendrick gained ground in each of them.

The Streaming Showdown: Loyalty vs. Virality

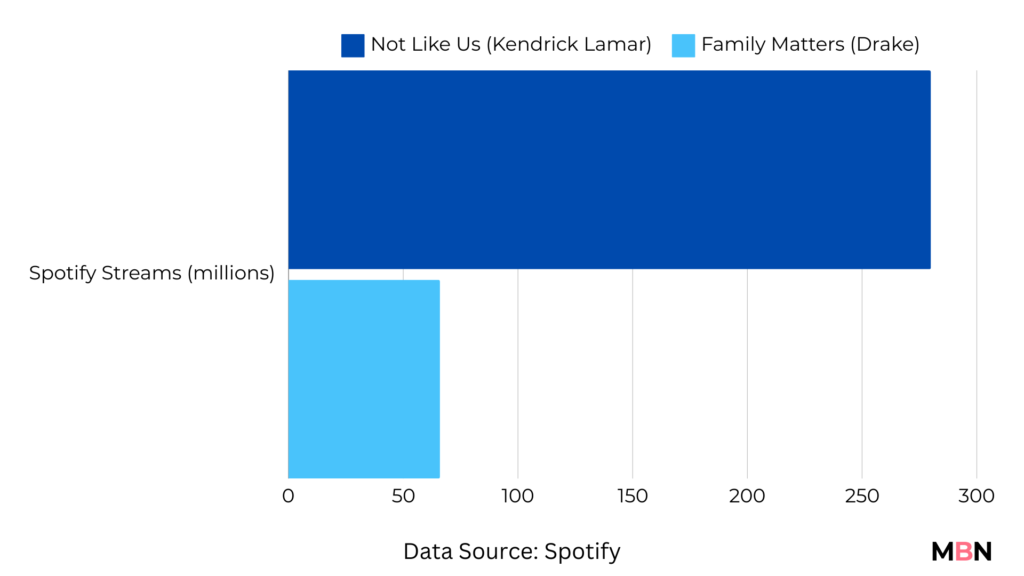

In the wake of Kendrick’s numerous diss tracks, including the most popular of them all “Not Like Us,” (amassing 280 million streams and 2,000+ playlist placements on Spotify alone) his monthly Spotify listener count surged by an impressive 27 million. Drake, meanwhile, saw a comparatively modest dip of 1.5 million monthly listeners since the start of the feud, with his most popular Kendrick-diss “Family Matters” totaling a mere 66 million Spotify streams and 700 playlists on the platform. On the surface, this might suggest a clear win for Kendrick. However, a deeper dive into listener retention rates tells a more complex story.

Drake’s retention rate actually increased from 105% to 109% during this period, indicating that his core fanbase remains remarkably steadfast in their loyalty, even in the face of Kendrick’s onslaught. Additionally, Drake’s monthly listener count on Spotify, even after a 1.5 million dip, still towers over Kendrick’s but only slightly at 82.5 million to 78 million – a much closer gap than before the ‘war’.

Kendrick, on the other hand, saw his retention rate plummet from 43% to 38%, suggesting that many of his newly-gained listeners may be more curious onlookers than devoted fans.

This data paints a picture of two contrasting strategies – one focused on cultivating deep, lasting loyalty, the other on generating viral moments and sparking widespread curiosity. While Kendrick’s approach may be winning the battle for short-term attention, Drake’s strategy could prove more effective in the long-term war for enduring dominance.

Kendrick’s cultural references in his diss tracks is likely what ignited and engaged more of his U.S. audience. Meanwhile, the strength of his overall catalog has allowed Drake to rely on his status as a global superstar, betting on the continued reliability of his massive global audience to absorb any blowback.

Radio Waves Shift: Kendrick's Domestic Surge

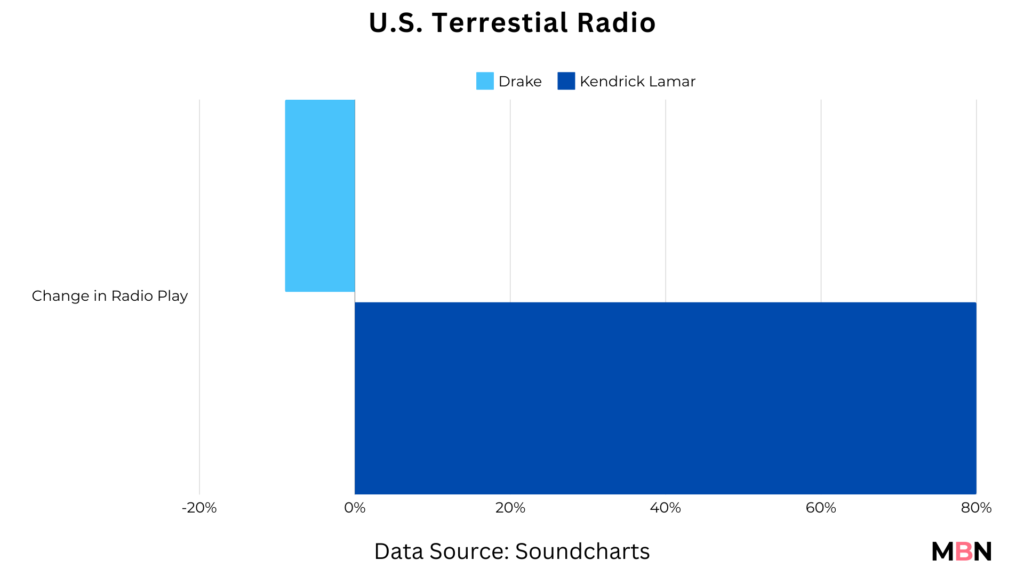

Soundcharts data also point to a change in radio play dynamics over the last month. While Drake’s radio spins dipped slightly in the U.S. (-9%) and U.K. (-6%) – two of his top markets – Kendrick Lamar has seen an 80% increase in U.S. radio play in the wake of feud. Lamar’s increased radio play in the U.S. was, unsurprisingly, driven by airplay of “Not Like Us” in the Los Angeles area (his home county) on stations such as Power106 and KRRL-FM Real 92.3 (responsible for Kendrick’s highest number of global radio plays over the last month).

Most tellingly, but somewhat expected, the LA-based Real 92.3, the station that has been Kendrick’s staunchest cheerleader, cut Drake’s airplay by a staggering 30% during the month of May.

This domestic dominant radio surge for Kendrick, coupled with the increase in U.S. streaming share for his diss tracks might speak to the effectiveness of his regionally-focused strategy in comparison to Drake’s. And with the U.S. being the biggest market for the Hip Hop genre, it is not difficult to see why a strategy like this has created such an impact in his battle with the Toronto-based rapper.

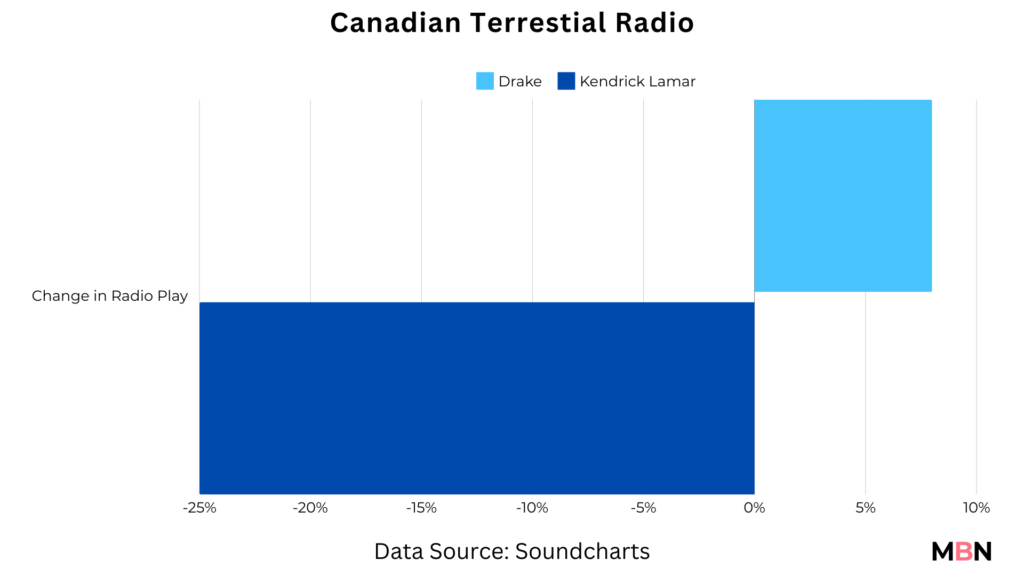

In Drake’s case, despite facing slight challenges in the U.S. radio market during the feud, the ‘6 God’ has managed to maintain his global radio dominance by making up ground key local and international markets in regions such as France (up 12%) and his home country of Canada (up 8%), where Kendrick has seen a 25% decline in airplay.

In saying that, like Drake, Kendrick has also compensated by making significant progress in other international radio markets over the past month – such as Nigeria (+104% in spins) and portions of Europe (U.K. +40%, Belgium +27%, Germany +26%, ).

Kendrick's Viral Breakthrough: The TikTok Wildcard

Where Drake may be ahead in terms of the raw numbers of streams and spins of his overall catalog, when it comes to the virality of this feud, Kendrick has taken the crown by more than a mile.

In just one month after its release, “Not Like Us” was the soundtrack for 560,000+ TikTok videos and 1.4 billion views, quickly becoming his third most popular song on the platform as lead artist (surpassing “We Cry Together”, from his most recent album ‘Mr. Morale & The Big Steppers’). The uptick is arguably a testament to Kendrick’s ‘hidden’ ability to create a moment that lands with TikTok’s wide audience often moved by the winds of popularity – something Drake was more known for excelling at prior to the feud. Drizzy’s most popular TikTok song “Tootsie Slide” has amassed 2.8 million videos and 8.2 billion views, compared to Kendrick’s 1.1 million videos and 1.3 billion videos for his most popular TikTok song “HUMBLE”. Notably, “Not Like Us” has accumulated more TikTok views than “HUMBLE.” with half the number of videos, speaking to its undeniable cultural impact.

Drake’s most popular song in the ‘back and forth’ with Lamar, “Family Matters”, stands at just 1,800 TikTok videos and 7.5 million views.

In an era where a single viral moment can redefine an artist’s trajectory, Kendrick’s overwhelming TikTok triumph in this feud could be an extremely powerful weapon in his arsenal. If he can sustain this momentum and translate the buzz into lasting listener growth and engagement, it could dramatically redefine of his overall positioning. Should the feud continue in any way, this is a wildcard that Drake (despite his overall dominance) cannot afford to ignore.

Looking Ahead...

With all that said, one thing is clear: the Drake-Kendrick beef was much more than a rap beef. As the reams of data show, it’s a rich, multifaceted playbook for how different strategies can determine equally impactful yet completely different outcomes. Every artist has their own unique arsenal of strengths and strategies — Drake’s unbreakable global grip and resistance to wobble in the storm, Kendrick’s gift for the viral moment and local relevance — which we’ll continue to watch with his future releases.

Get weekly music biz updates straight to your inbox.

MBN Staff

Entertainment

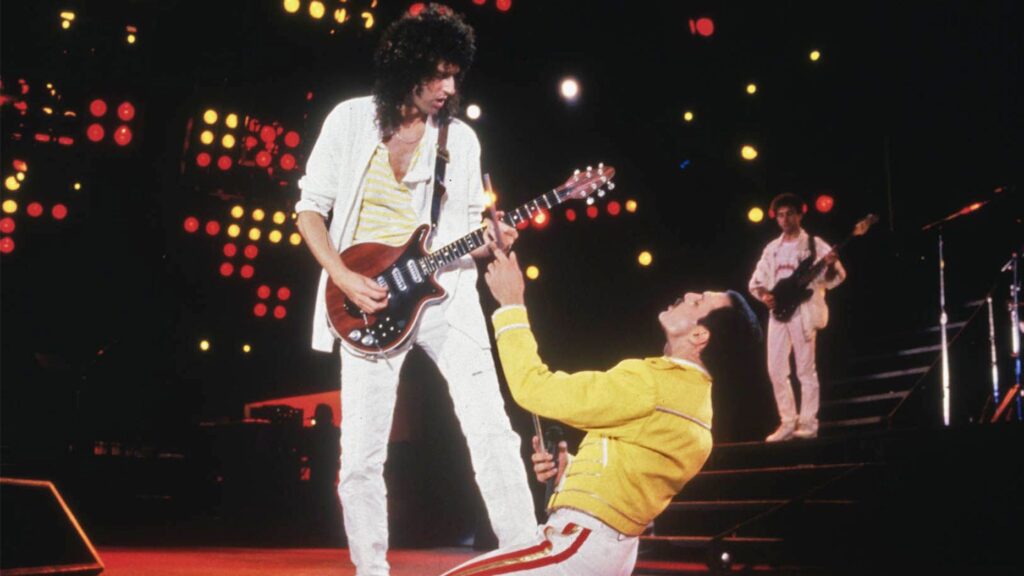

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Source says discussions between Queen and Sony Music over the British band’s catalog sale have been ongoing since last year.

Published

2 months agoon

Thursday, 30 May 2024 @ 13:46 EDT

Story Highlights

Sony’s potential deal for Queen’s music assets could make it the biggest single-artist catalog acquisition in history.

According to multiple outlets, sources report that iconic British rock band Queen has been seeking a valuation of around $1.2 billion for its music assets, which consist of both publishing and master recording rights jointly owned by the band’s surviving members Brian May, Roger Taylor and John Deacon, as well as the Freddie Mercury estate. Bloomberg first reported that Sony Music is the undisclosed suitor currently in an exclusive negotiating window with Queen, working with an unnamed financial partner.

Music Business Worldwide originally broke news of the catalog being shopped for a 9-figure sum in May 2023, noting that major labels like Universal Music Group and private equity players had engaged in discussions.

Of course, putting together a deal of this magnitude and complexity, especially with multiple stakeholders involved, comes with no guarantee of closer. As a cautionary example, sources say Pink Floyd’s attempt to sell their catalog for $500 million collapsed in 2022 due to band members having differing priorities.

Inside Queen's Financial Performance

Music Business Worldwide also reported that Queen Productions Ltd, the UK entity housing the band’s recordings, reported £40.89 million ($50.41m) in turnover for the fiscal year ending September 2022, a 4.3% increase over 2021. Profit before taxes jumped 31.6% to £22.16 million ($27.41m).

Much of this growth likely stems from the popularity boost following the band’s 2018 biopic Bohemian Rhapsody. In fact, the FY2022 revenue figure more than tripled Queen’s £12.34 million turnover ($16.72m) in FY2016 before the film’s release. The band’s enduring appeal is further evidenced by the nearly 38 million album consumption units and 46 billion on-demand global streams their catalog has amassed since 1991, according to Luminate and reported by Billboard.

Implications of a Billion-Dollar Sale

If completed in the $1 billion range as reported, Queen’s sale would handily surpass Bruce Springsteen’s $500 million+ catalog deal with Sony in 2021 to become the biggest transaction for a single artist’s body of work. It would also dwarf the $600 million Sony allegedly paid in February for 50% of Michael Jackson’s catalog. Though, technically speaking, with only the remaining 50% sold, the deal with the Jackson estate valued the late King of Pop’s catalog at $1.2 billion – slightly above than the reported $1 billion offer of Queen’s work, if that number is exact.

However, Queen’s situation is a little more complicated due to Disney Music Group’s current rights to their master recordings in North America under the Hollywood Records umbrella. Any acquirer would need to navigate that structure and DMG’s global distribution pact with Universal.

The stratospheric valuations attached to evergreen hit songs have enticed artists to cash in on their life’s work, accepting a one-time capital gains tax rather than annual income taxes on royalties. But as the Hipgnosis Songs Fund has demonstrated, aggregating catalogs at premium prices fueled by cheap debt doesn’t automatically translate into strong returns. Blackstone’s takeover of Hipgnosis following a shareholder revolt underscores the potential risks of catalog acquisition sprees.

Queen, though, stands apart as one of the most commercially successful acts in history, notching six No. 1 singles and 10 No. 1 albums in the UK across five decades. With the right promotion and synch opportunities, dozens of their songs like “Bohemian Rhapsody,” “We Will Rock You,” and “Another One Bites the Dust” have the potential to generate substantial returns for decades to come. But at a $1 billion entry price, Sony or any other buyer will need to be confident they can unlock significantly more value to make the numbers work.

Get weekly music biz updates straight to your inbox.

MBN Staff

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Albums Chart Data: Swift & Eilish Dominate UK & US Listings