Analysis

The Live Music Industry may be on hold until Fall 2021

Bioethicist Zeke Emanuel told the NY Times it is not plausible to resume live events before Fall 2021.

Published

4 years agoon

Story Highlights

- Bioethicist Zeke Emanuel told the NY Times it is not plausible to resume live events before Fall 2021.

- Live Nation CEO, Michael Rapino, has forfeited his 2020 salary – as the company continues to deal with COVID-19.

In what was set to be a record-breaking year for live music revenue, Music Biz Nation previously reported that the COVID-19 pandemic could cost the live industry $9billion in 2019. This was based on recent findings by trade publication Pollstar, who said the figure was a ‘worst case scenario’ estimation – which was that live events will not resume for the remainder of 2020. However, according to Medical Expert and Bioethicist Ezekiel ‘Zeke’ Emanuel, it is not ‘plausible’ to assume large gatherings of any kind should take place anytime sooner than the latter of 2021.

In an interview with the NY Times, Emanuel was asked about how a workplace can do social distancing safely once steps are taken to ‘restart the economy’.

In response, Zeke – chair of the Department of Medical Ethics and Health Policy – said that it is possible in environments where six-foot distancing can reasonably be enforced – i.e. some offices.

Speaking on large gatherings, however, Emanuel said: “when people say they’re going to reschedule this conference or graduation event for October 2020, I have no idea how they think that’s a plausible possibility. I think those things will be the last to return. Realistically we’re talking fall 2021 at the earliest“.

Realistically we’re talking fall 2021 at the earliest

Zeke Emanuel (Oncologist and Bioethicist)

If this indeed holds true, it raises major concerns for the longterm economic health of the live music industry – and the hundreds of thousands of workers employed by it. This includes onstage talent (vocalists, dancers, instrumentalists), engineers (audio and visual), production crew, venue staff and security, bus drivers, and more.

We have reported on a number of funds that have opened up to support some of these workers financially whilst they face the fallout of a loss of income. Amongst these is Live Nation – who committed $10million to live industry workers – and opened up a merchandise store to help fans support these individuals.

However, as some of the companies opening funds are beginning to take precautions to protect their own economic future, it is unlikely many of these efforts will be able to sustain affected staff for another 17 months (fall 2021) – if this ends up being the resume period.

Live Nation’s CEO, Michael Rapino, has voluntarily forfeited his $3million base salary for the remainder of the year. Additionally, senior executives across the company will receive reduced salaries of up to 50%.

The company said in a statement: “Given the uncertainty associated with the duration of current conditions globally, the company has launched a number of initiatives to reduce fixed costs and conserve cash“.

Michael Rapino himself, shared: “With this additional liquidity, the flexibility in our debt covenants, and cost-cutting efforts, we believe that Live Nation has the financial strength to weather this difficult time. We will be ready to ramp back up quickly and once again connect audiences to artists at the concerts they are looking forward to“.

There is no telling just how great of an impact a potential resume date of Fall 2021 could be to the live industry. It is not, however, hard to understand how or why Zeke Emanuel may deem this a necessary move – as just one fan being infected in a crowd of 10,000 could invoke another pandemic.

Get weekly music biz updates straight to your inbox.

MBN Staff

Analysis

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

MBN Exclusive: New Soundcharts Data Shows The Cogs Working Behind Rap’s Hottest War.

Published

2 months agoon

Thursday, 6 June 2024 @ 20:51 EDT

Story Highlights

New data provides unprecedented insight into the underlying methodology of the Drake-Kendrick feud crucial to understanding the broader battle for hip-hop supremacy.

Few rivalries in the high-stakes world of hip hop superstardom have captured the cultural zeitgeist as completely as the recent feud between ‘Rap Gods’ Drake and Kendrick Lamar. Being two of the genre’s OGs, their every move sent reverberations through the music industry and beyond. A lot of the conversation around the ‘slugfest’ revolved around the surface-level spectacle of the diss tracks and opinions among fans, but the real narrative that shapes this feud is the one presented in the data (the streaming numbers, radio spins and listener trends that provide an insight into the way the two superstars’ strategies prior to the ‘war of words’ helped them to navigate this war behind the scenes.

A Geographic Dividend

As we previously reported at Music Biz Nation, data from Luminate – a premier music analytics company – showed an slight difference in how Drake and Kendrick diss tracks were being consumed regionally versus internationally in comparison to their overall catalogs. In Kendrick’s case, American listeners were responsible for 62.2% of streams on his Drake diss tracks, 11.5% above his typical 50.7% U.S. share. Meanwhile, Drake saw only a small boost in U.S. streams for his Kendrick disses, bumping from 58.9% to 60.1% – with the remainder coming from international markets.

Getting more specific, Kendrick’s top listenership on Spotify stems from Los Angeles (also his top radio market), London and Chicago (all seeing a 2-3% monthly increase in the past month). Drake still comfortably maintained an 82.5 million to Kendrick’s 78 million in Spotify monthly listeners over the past 28 days, with his top markets on the platform being London, Los Angeles, and New York. Notably, Drake saw a 1-2% dip in listenership in all three of his top markets, while Kendrick gained ground in each of them.

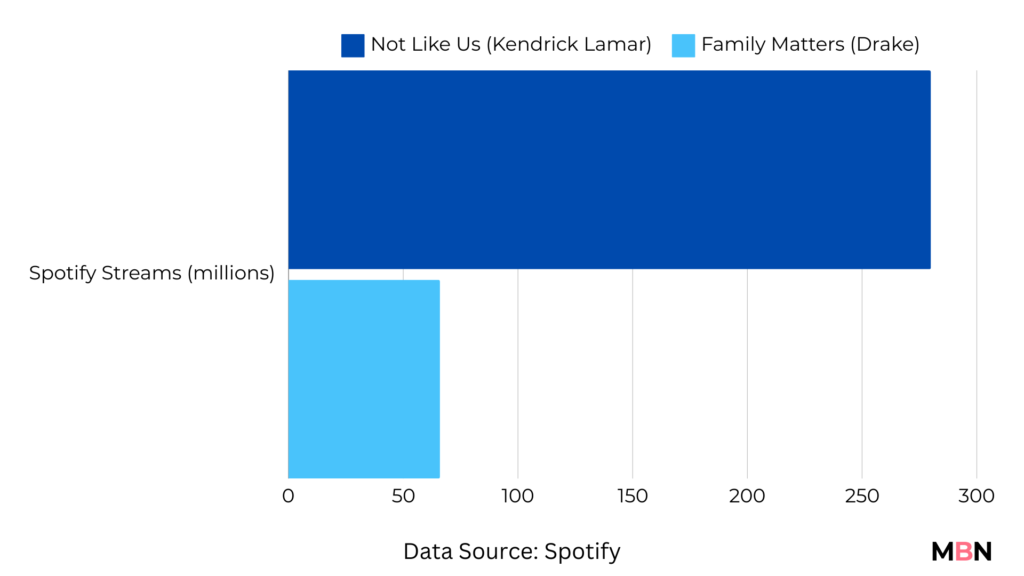

The Streaming Showdown: Loyalty vs. Virality

In the wake of Kendrick’s numerous diss tracks, including the most popular of them all “Not Like Us,” (amassing 280 million streams and 2,000+ playlist placements on Spotify alone) his monthly Spotify listener count surged by an impressive 27 million. Drake, meanwhile, saw a comparatively modest dip of 1.5 million monthly listeners since the start of the feud, with his most popular Kendrick-diss “Family Matters” totaling a mere 66 million Spotify streams and 700 playlists on the platform. On the surface, this might suggest a clear win for Kendrick. However, a deeper dive into listener retention rates tells a more complex story.

Drake’s retention rate actually increased from 105% to 109% during this period, indicating that his core fanbase remains remarkably steadfast in their loyalty, even in the face of Kendrick’s onslaught. Additionally, Drake’s monthly listener count on Spotify, even after a 1.5 million dip, still towers over Kendrick’s but only slightly at 82.5 million to 78 million – a much closer gap than before the ‘war’.

Kendrick, on the other hand, saw his retention rate plummet from 43% to 38%, suggesting that many of his newly-gained listeners may be more curious onlookers than devoted fans.

This data paints a picture of two contrasting strategies – one focused on cultivating deep, lasting loyalty, the other on generating viral moments and sparking widespread curiosity. While Kendrick’s approach may be winning the battle for short-term attention, Drake’s strategy could prove more effective in the long-term war for enduring dominance.

Kendrick’s cultural references in his diss tracks is likely what ignited and engaged more of his U.S. audience. Meanwhile, the strength of his overall catalog has allowed Drake to rely on his status as a global superstar, betting on the continued reliability of his massive global audience to absorb any blowback.

Radio Waves Shift: Kendrick's Domestic Surge

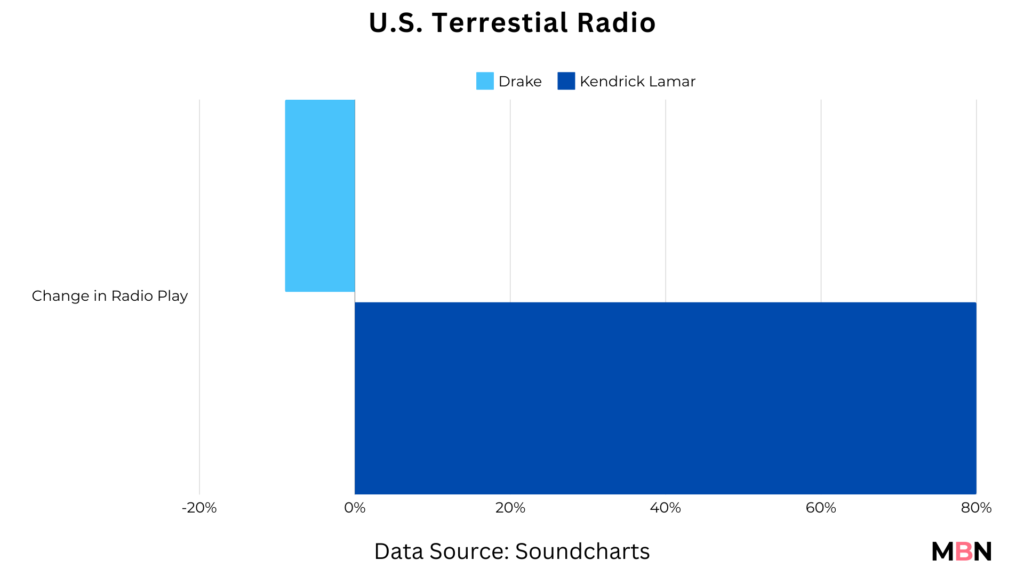

Soundcharts data also point to a change in radio play dynamics over the last month. While Drake’s radio spins dipped slightly in the U.S. (-9%) and U.K. (-6%) – two of his top markets – Kendrick Lamar has seen an 80% increase in U.S. radio play in the wake of feud. Lamar’s increased radio play in the U.S. was, unsurprisingly, driven by airplay of “Not Like Us” in the Los Angeles area (his home county) on stations such as Power106 and KRRL-FM Real 92.3 (responsible for Kendrick’s highest number of global radio plays over the last month).

Most tellingly, but somewhat expected, the LA-based Real 92.3, the station that has been Kendrick’s staunchest cheerleader, cut Drake’s airplay by a staggering 30% during the month of May.

This domestic dominant radio surge for Kendrick, coupled with the increase in U.S. streaming share for his diss tracks might speak to the effectiveness of his regionally-focused strategy in comparison to Drake’s. And with the U.S. being the biggest market for the Hip Hop genre, it is not difficult to see why a strategy like this has created such an impact in his battle with the Toronto-based rapper.

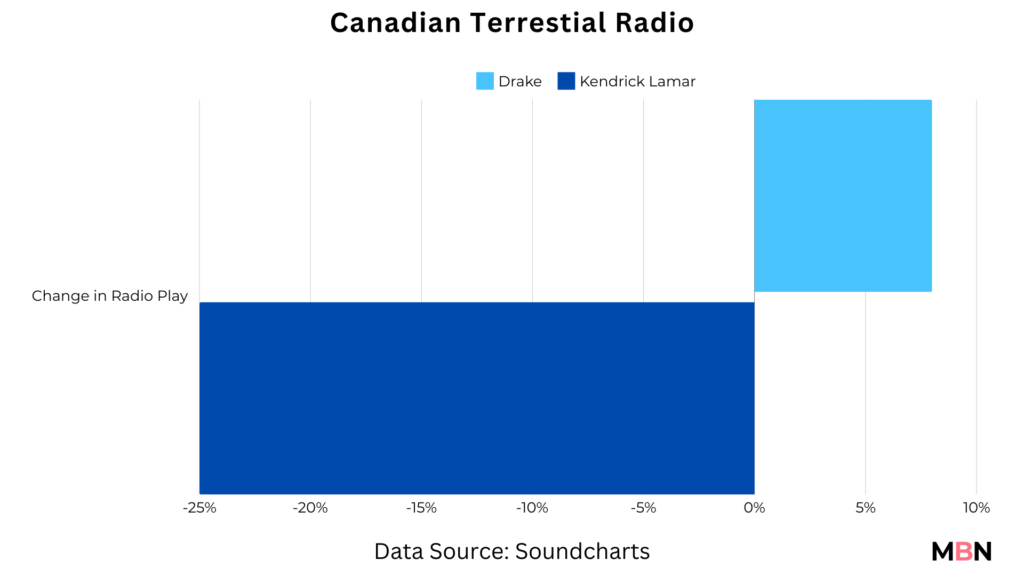

In Drake’s case, despite facing slight challenges in the U.S. radio market during the feud, the ‘6 God’ has managed to maintain his global radio dominance by making up ground key local and international markets in regions such as France (up 12%) and his home country of Canada (up 8%), where Kendrick has seen a 25% decline in airplay.

In saying that, like Drake, Kendrick has also compensated by making significant progress in other international radio markets over the past month – such as Nigeria (+104% in spins) and portions of Europe (U.K. +40%, Belgium +27%, Germany +26%, ).

Kendrick's Viral Breakthrough: The TikTok Wildcard

Where Drake may be ahead in terms of the raw numbers of streams and spins of his overall catalog, when it comes to the virality of this feud, Kendrick has taken the crown by more than a mile.

In just one month after its release, “Not Like Us” was the soundtrack for 560,000+ TikTok videos and 1.4 billion views, quickly becoming his third most popular song on the platform as lead artist (surpassing “We Cry Together”, from his most recent album ‘Mr. Morale & The Big Steppers’). The uptick is arguably a testament to Kendrick’s ‘hidden’ ability to create a moment that lands with TikTok’s wide audience often moved by the winds of popularity – something Drake was more known for excelling at prior to the feud. Drizzy’s most popular TikTok song “Tootsie Slide” has amassed 2.8 million videos and 8.2 billion views, compared to Kendrick’s 1.1 million videos and 1.3 billion videos for his most popular TikTok song “HUMBLE”. Notably, “Not Like Us” has accumulated more TikTok views than “HUMBLE.” with half the number of videos, speaking to its undeniable cultural impact.

Drake’s most popular song in the ‘back and forth’ with Lamar, “Family Matters”, stands at just 1,800 TikTok videos and 7.5 million views.

In an era where a single viral moment can redefine an artist’s trajectory, Kendrick’s overwhelming TikTok triumph in this feud could be an extremely powerful weapon in his arsenal. If he can sustain this momentum and translate the buzz into lasting listener growth and engagement, it could dramatically redefine of his overall positioning. Should the feud continue in any way, this is a wildcard that Drake (despite his overall dominance) cannot afford to ignore.

Looking Ahead...

With all that said, one thing is clear: the Drake-Kendrick beef was much more than a rap beef. As the reams of data show, it’s a rich, multifaceted playbook for how different strategies can determine equally impactful yet completely different outcomes. Every artist has their own unique arsenal of strengths and strategies — Drake’s unbreakable global grip and resistance to wobble in the storm, Kendrick’s gift for the viral moment and local relevance — which we’ll continue to watch with his future releases.

Get weekly music biz updates straight to your inbox.

MBN Staff

Analysis

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Luminate’s streaming data from Drake and Kendrick Lamar’s viral diss tracks uncovers two starkly different blueprints for sustaining audience engagement in the streaming era.

Published

2 months agoon

Wednesday, 29 May 2024 @ 14:42 EDT

Story Highlights

Luminate’s data on the diss tracks demonstrate two starkly different blueprints for sustainability in the streaming era.

The recent diss track showdown between hip hop giants Kendrick Lamar and Drake undoubtedly captured the attention of music fans across the globe. The lyrical jabs traded between the rap heavyweights on their respective diss tracks not only lit up social media with heated debates among diehard fans, but also drew in more casual observers, brands, and even political figures to join the online discourse.

Speaking to political media outlet The Hill, Rep. Jamaal Bowman (D-N.Y.) stated: “Hopefully, it inspires others to keep the culture going in the most in the best ways possible”. Further adding that “it is bringing attention to the culture” and “showing the creative brilliance of emcees.”

However, while much of the conversation centered around the subjective question of who emerged victorious, new data from music analytics firm Luminate reveals an interesting discrepancy in the geographic streaming breakdown for the diss tracks compared to the rappers’ overall catalogs.

Kendrick Lamar Sees Significant Spike in U.S. Streaming Share

For Drake, streams of his diss tracks skewed slightly more domestic, with U.S. listeners accounting for 60.1% of the total, a modest uptick from his typical 58.9% U.S. streaming share. On the flip side, the difference was much more pronounced for Kendrick Lamar.

Lamar’s catalog normally posts a nearly even 50.7% U.S. to 49.3% non-U.S. split. But for his Drake-diss tracks, domestic U.S. audiences represented a 62.2% majority of total streams, a substantial 11.5 percentage point increase versus his usual U.S. audience share.

Divergent Approaches, Common Goal

Placed side-by-side, the Luminate data presents a study in contrasts. For Kendrick, the diss track numbers hint at the potential rewards of striking a chord (no pun intended) with a specific regional audience. Whereas for Drake, the numbers might showcase the value of maintaining a solid global listenership that can weather any storm.

As the streaming landscape grows ever-more saturated and competitive, the stakes of these strategies are only getting higher. With so many artists vying for a finite share of listener attention, the ability to accurately identify and capitalize on opportunities for local resonance while maintaining a loyal global fanbase has become an almost-essential strategy.

Ultimately, the Luminate data makes it clear that, in the age of on-demand audio, there’s no one-size-fits-all formula for sustainable success. With the world of streaming continuing to evolve, artists who can effectively leverage real-time audience data to inform their strategies may be the ones best-positioned to navigate the current and future landscape. This may involve carefully calibrating their approach to strike a balance between cultivating deep regional resonance and maintaining a broad, mainstream appeal that translates across borders.

While the Drake-Kendrick data highlights two contrasting strategic approaches, it underscores one universal imperative: in an increasingly crowded arena, appeal and agility are among an artist’s most valuable assets

Get weekly music biz updates straight to your inbox.

MBN Staff

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Albums Chart Data: Swift & Eilish Dominate UK & US Listings