Analysis

Brexit may derail the UK Music Industry’s $5.8bn success

WOMAD Director claims that Artist are ‘losing interest’ in performing in the UK due to rigorous visa processes.

Published

6 years agoon

Story Highlights

- WOMAD Director claims that Artist are ‘losing interest’ in performing in the UK due to rigorous visa processes.

- The musicians have been lobbying the British Government to create an EU touring visa, post-brexit.

The UK Music Industry saw unprecedented growth last year. International success of acts like Rag’n’Bone Man, Dua Lip, Stormzy, and of course, Ed Sheeran boosted revenues to a record-breaking $5.8bn (£4.5bn). Additionally, talent from the British shores racked up huge numbers on the road, accounting for five of the top ten highest grossing tours of the year – thanks to legendary artists such as Sir Paul McCartney, Rolling Stones, and Coldplay. In total, live music alone contributed $1.3bn (£991m) to the UK economy. However, with growing concerns of what Brexit may mean for British Music once a deal is finalized, many are wondering whether or not this growing success will be given room to continue.

Whilst many key industry figures are pleased with the recent numbers that indicate healthy growth over the past year, they have also been just as vocal about how important a ‘good deal’ is necessary in order for the UK Music Industry to continues thriving. Speaking to The Independent, UK Music CEO Michael Dugher said they are taking a “vigilant approach” in regards to monitoring the transition period during the Brexit process to ensure minimal negative effect if any at all. Whilst this may be ideal, the reality of EU relations since the referendum alone have resulted in contentious issues in regards to foreign Artists being able to tour in the UK.

WOMAD Festival Director Chris Smith spoke to the Radio Times, stating that since the result of the referendum, a number of Artists are losing interest in coming to the UK to perform due to the “difficult and humiliating” process of trying to obtain a visa.

“We’ve had situations where, say, an African artist has been due to come who plays a particularly rare instrument, and we’ll be asked: ‘Can’t you find someone in the UK who plays that instrument?’, which is absurd,” said Smith.

Considering Brexit is still pending, this most certainly justifies a cause for concern. We’ve had situations where, say, an African artist has been due to come who plays a particularly rare instrument, and we’ll be asked: ‘Can’t you find someone in the UK who plays that instrument?’.

Globally, live music accounted for around $25bn in revenue for 2017 – and is projected to hit over $30bn by 2022. It has had the longest-standing year-on-year growth in comparison to any other form of music and thus a very key element in the overall health of the music business, specifically in the UK where touring makes up for well over 20% of industry revenues. A Brexit deal that adds further restrictions to UK touring could most certainly threaten these numbers.

One of the organizations who has taken action to hopefully get ahead this potential issue is the Musicians Union – who have been lobbying the British Government for over a year for freedom of movement to continue. As part of their campaign to ensure touring is not stifled, they have suggested a post-Brexit ‘EU touring visa’ for musicians and performers within all EU member states that is ‘affordable, multi-entry, and admin-light”. So far, their petition has gained over 16,000 signatures – which is enough to receive a response from a government, but still significantly off the ‘100,000’ mark it’ll need to hit in order for it to be discussed in government.

Earlier this year, Margot James (Minister of Creative and Digital Industries) said she “is committed to building on the achievements” of the UK Music Industry, in light of its growth over the past year. However, with March 2019 fast approaching, she will need to put that ‘commitment’ into serious action rather imminently.

MBN Staff

Analysis

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

MBN Exclusive: New Soundcharts Data Shows The Cogs Working Behind Rap’s Hottest War.

Published

2 months agoon

Thursday, 6 June 2024 @ 20:51 EDT

Story Highlights

New data provides unprecedented insight into the underlying methodology of the Drake-Kendrick feud crucial to understanding the broader battle for hip-hop supremacy.

Few rivalries in the high-stakes world of hip hop superstardom have captured the cultural zeitgeist as completely as the recent feud between ‘Rap Gods’ Drake and Kendrick Lamar. Being two of the genre’s OGs, their every move sent reverberations through the music industry and beyond. A lot of the conversation around the ‘slugfest’ revolved around the surface-level spectacle of the diss tracks and opinions among fans, but the real narrative that shapes this feud is the one presented in the data (the streaming numbers, radio spins and listener trends that provide an insight into the way the two superstars’ strategies prior to the ‘war of words’ helped them to navigate this war behind the scenes.

A Geographic Dividend

As we previously reported at Music Biz Nation, data from Luminate – a premier music analytics company – showed an slight difference in how Drake and Kendrick diss tracks were being consumed regionally versus internationally in comparison to their overall catalogs. In Kendrick’s case, American listeners were responsible for 62.2% of streams on his Drake diss tracks, 11.5% above his typical 50.7% U.S. share. Meanwhile, Drake saw only a small boost in U.S. streams for his Kendrick disses, bumping from 58.9% to 60.1% – with the remainder coming from international markets.

Getting more specific, Kendrick’s top listenership on Spotify stems from Los Angeles (also his top radio market), London and Chicago (all seeing a 2-3% monthly increase in the past month). Drake still comfortably maintained an 82.5 million to Kendrick’s 78 million in Spotify monthly listeners over the past 28 days, with his top markets on the platform being London, Los Angeles, and New York. Notably, Drake saw a 1-2% dip in listenership in all three of his top markets, while Kendrick gained ground in each of them.

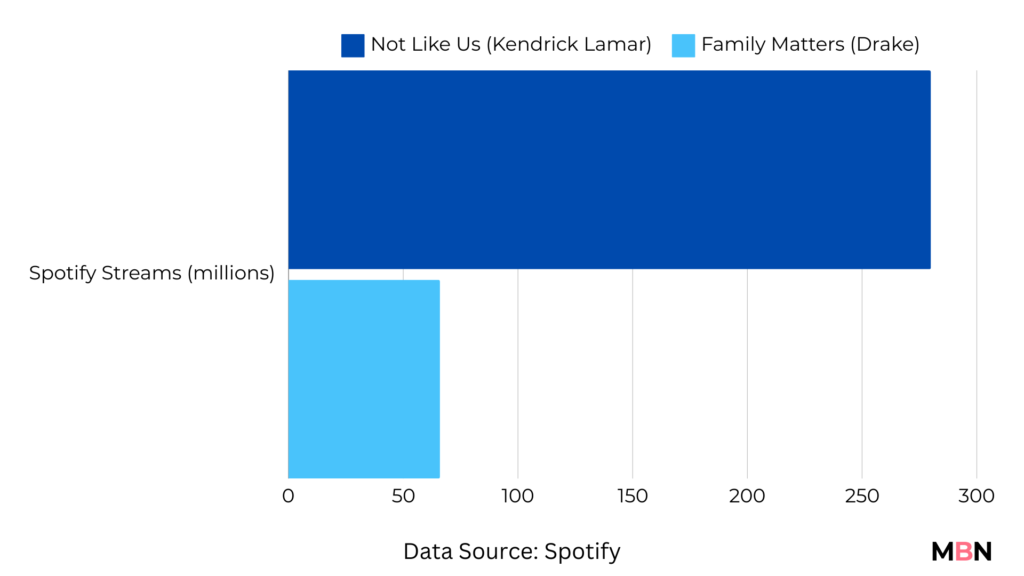

The Streaming Showdown: Loyalty vs. Virality

In the wake of Kendrick’s numerous diss tracks, including the most popular of them all “Not Like Us,” (amassing 280 million streams and 2,000+ playlist placements on Spotify alone) his monthly Spotify listener count surged by an impressive 27 million. Drake, meanwhile, saw a comparatively modest dip of 1.5 million monthly listeners since the start of the feud, with his most popular Kendrick-diss “Family Matters” totaling a mere 66 million Spotify streams and 700 playlists on the platform. On the surface, this might suggest a clear win for Kendrick. However, a deeper dive into listener retention rates tells a more complex story.

Drake’s retention rate actually increased from 105% to 109% during this period, indicating that his core fanbase remains remarkably steadfast in their loyalty, even in the face of Kendrick’s onslaught. Additionally, Drake’s monthly listener count on Spotify, even after a 1.5 million dip, still towers over Kendrick’s but only slightly at 82.5 million to 78 million – a much closer gap than before the ‘war’.

Kendrick, on the other hand, saw his retention rate plummet from 43% to 38%, suggesting that many of his newly-gained listeners may be more curious onlookers than devoted fans.

This data paints a picture of two contrasting strategies – one focused on cultivating deep, lasting loyalty, the other on generating viral moments and sparking widespread curiosity. While Kendrick’s approach may be winning the battle for short-term attention, Drake’s strategy could prove more effective in the long-term war for enduring dominance.

Kendrick’s cultural references in his diss tracks is likely what ignited and engaged more of his U.S. audience. Meanwhile, the strength of his overall catalog has allowed Drake to rely on his status as a global superstar, betting on the continued reliability of his massive global audience to absorb any blowback.

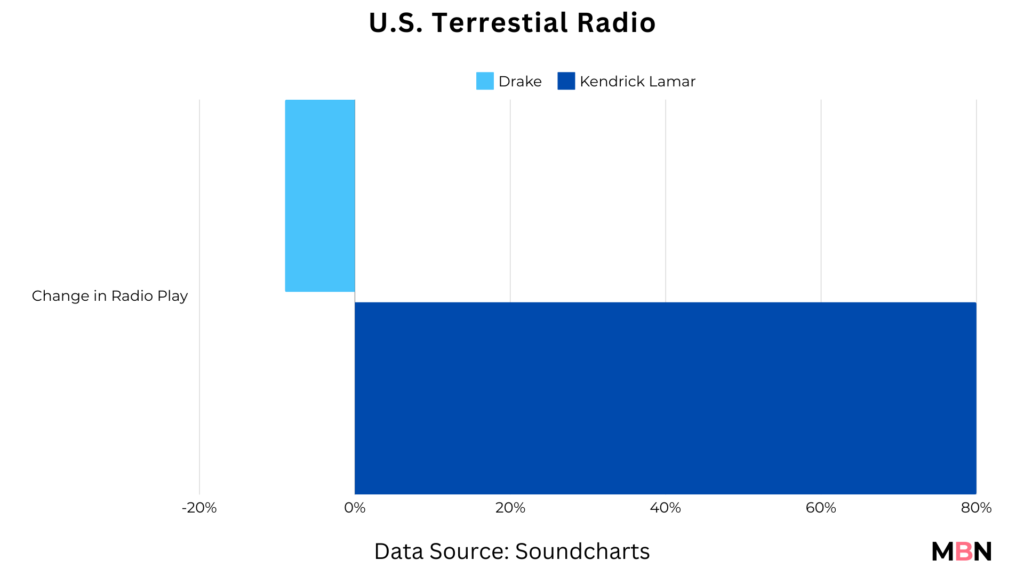

Radio Waves Shift: Kendrick's Domestic Surge

Soundcharts data also point to a change in radio play dynamics over the last month. While Drake’s radio spins dipped slightly in the U.S. (-9%) and U.K. (-6%) – two of his top markets – Kendrick Lamar has seen an 80% increase in U.S. radio play in the wake of feud. Lamar’s increased radio play in the U.S. was, unsurprisingly, driven by airplay of “Not Like Us” in the Los Angeles area (his home county) on stations such as Power106 and KRRL-FM Real 92.3 (responsible for Kendrick’s highest number of global radio plays over the last month).

Most tellingly, but somewhat expected, the LA-based Real 92.3, the station that has been Kendrick’s staunchest cheerleader, cut Drake’s airplay by a staggering 30% during the month of May.

This domestic dominant radio surge for Kendrick, coupled with the increase in U.S. streaming share for his diss tracks might speak to the effectiveness of his regionally-focused strategy in comparison to Drake’s. And with the U.S. being the biggest market for the Hip Hop genre, it is not difficult to see why a strategy like this has created such an impact in his battle with the Toronto-based rapper.

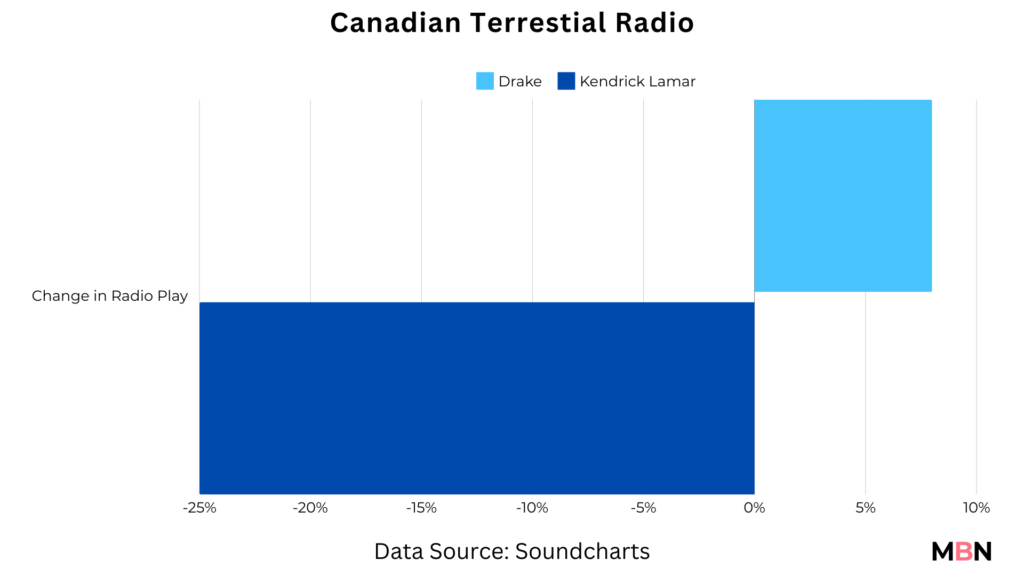

In Drake’s case, despite facing slight challenges in the U.S. radio market during the feud, the ‘6 God’ has managed to maintain his global radio dominance by making up ground key local and international markets in regions such as France (up 12%) and his home country of Canada (up 8%), where Kendrick has seen a 25% decline in airplay.

In saying that, like Drake, Kendrick has also compensated by making significant progress in other international radio markets over the past month – such as Nigeria (+104% in spins) and portions of Europe (U.K. +40%, Belgium +27%, Germany +26%, ).

Kendrick's Viral Breakthrough: The TikTok Wildcard

Where Drake may be ahead in terms of the raw numbers of streams and spins of his overall catalog, when it comes to the virality of this feud, Kendrick has taken the crown by more than a mile.

In just one month after its release, “Not Like Us” was the soundtrack for 560,000+ TikTok videos and 1.4 billion views, quickly becoming his third most popular song on the platform as lead artist (surpassing “We Cry Together”, from his most recent album ‘Mr. Morale & The Big Steppers’). The uptick is arguably a testament to Kendrick’s ‘hidden’ ability to create a moment that lands with TikTok’s wide audience often moved by the winds of popularity – something Drake was more known for excelling at prior to the feud. Drizzy’s most popular TikTok song “Tootsie Slide” has amassed 2.8 million videos and 8.2 billion views, compared to Kendrick’s 1.1 million videos and 1.3 billion videos for his most popular TikTok song “HUMBLE”. Notably, “Not Like Us” has accumulated more TikTok views than “HUMBLE.” with half the number of videos, speaking to its undeniable cultural impact.

Drake’s most popular song in the ‘back and forth’ with Lamar, “Family Matters”, stands at just 1,800 TikTok videos and 7.5 million views.

In an era where a single viral moment can redefine an artist’s trajectory, Kendrick’s overwhelming TikTok triumph in this feud could be an extremely powerful weapon in his arsenal. If he can sustain this momentum and translate the buzz into lasting listener growth and engagement, it could dramatically redefine of his overall positioning. Should the feud continue in any way, this is a wildcard that Drake (despite his overall dominance) cannot afford to ignore.

Looking Ahead...

With all that said, one thing is clear: the Drake-Kendrick beef was much more than a rap beef. As the reams of data show, it’s a rich, multifaceted playbook for how different strategies can determine equally impactful yet completely different outcomes. Every artist has their own unique arsenal of strengths and strategies — Drake’s unbreakable global grip and resistance to wobble in the storm, Kendrick’s gift for the viral moment and local relevance — which we’ll continue to watch with his future releases.

Get weekly music biz updates straight to your inbox.

MBN Staff

Analysis

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Luminate’s streaming data from Drake and Kendrick Lamar’s viral diss tracks uncovers two starkly different blueprints for sustaining audience engagement in the streaming era.

Published

2 months agoon

Wednesday, 29 May 2024 @ 14:42 EDT

Story Highlights

Luminate’s data on the diss tracks demonstrate two starkly different blueprints for sustainability in the streaming era.

The recent diss track showdown between hip hop giants Kendrick Lamar and Drake undoubtedly captured the attention of music fans across the globe. The lyrical jabs traded between the rap heavyweights on their respective diss tracks not only lit up social media with heated debates among diehard fans, but also drew in more casual observers, brands, and even political figures to join the online discourse.

Speaking to political media outlet The Hill, Rep. Jamaal Bowman (D-N.Y.) stated: “Hopefully, it inspires others to keep the culture going in the most in the best ways possible”. Further adding that “it is bringing attention to the culture” and “showing the creative brilliance of emcees.”

However, while much of the conversation centered around the subjective question of who emerged victorious, new data from music analytics firm Luminate reveals an interesting discrepancy in the geographic streaming breakdown for the diss tracks compared to the rappers’ overall catalogs.

Kendrick Lamar Sees Significant Spike in U.S. Streaming Share

For Drake, streams of his diss tracks skewed slightly more domestic, with U.S. listeners accounting for 60.1% of the total, a modest uptick from his typical 58.9% U.S. streaming share. On the flip side, the difference was much more pronounced for Kendrick Lamar.

Lamar’s catalog normally posts a nearly even 50.7% U.S. to 49.3% non-U.S. split. But for his Drake-diss tracks, domestic U.S. audiences represented a 62.2% majority of total streams, a substantial 11.5 percentage point increase versus his usual U.S. audience share.

Divergent Approaches, Common Goal

Placed side-by-side, the Luminate data presents a study in contrasts. For Kendrick, the diss track numbers hint at the potential rewards of striking a chord (no pun intended) with a specific regional audience. Whereas for Drake, the numbers might showcase the value of maintaining a solid global listenership that can weather any storm.

As the streaming landscape grows ever-more saturated and competitive, the stakes of these strategies are only getting higher. With so many artists vying for a finite share of listener attention, the ability to accurately identify and capitalize on opportunities for local resonance while maintaining a loyal global fanbase has become an almost-essential strategy.

Ultimately, the Luminate data makes it clear that, in the age of on-demand audio, there’s no one-size-fits-all formula for sustainable success. With the world of streaming continuing to evolve, artists who can effectively leverage real-time audience data to inform their strategies may be the ones best-positioned to navigate the current and future landscape. This may involve carefully calibrating their approach to strike a balance between cultivating deep regional resonance and maintaining a broad, mainstream appeal that translates across borders.

While the Drake-Kendrick data highlights two contrasting strategic approaches, it underscores one universal imperative: in an increasingly crowded arena, appeal and agility are among an artist’s most valuable assets

Get weekly music biz updates straight to your inbox.

MBN Staff

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Albums Chart Data: Swift & Eilish Dominate UK & US Listings