News

ASCAP, BMI and SESAC open MusiCares relief fund for songwriters

Donations to the MusiCares COVID-19 relief fund have now exceeded $10million.

Published

4 years agoon

Story Highlights

- Donations to the MusiCares COVID-19 relief fund have now exceeded $10million.

- The Recording Academy says more is needed to meet the growing demand.

Performing Rights Organizations have joined in with the widespread donations to MusiCares, in aid of music professionals affected by the COVID-19 pandemic. ASCAP, BMI and SESAC have, together, opened a special MusiCares fund to specifically cater to songwriters and composers. Whilst the MusiCares fund (which has now exceeded $10million) was already open for music creatives in need of financial assistance, this newly-created songwriters fund will be available only to members and affiliates of the three performing rights organizations.

Though donations to the overall MusiCares fund has gone beyond expectations, so has the demand. Thus, according to a statement released today by The Recording Academy, more finances are needed to meet the needs of industry workers – as the coronavirus impact continues to take effect.

“It‘s inspiring to see every sector of the music industry band together during a time of need”, said Harvey Mason Jr. – Chairman of The Recording Academy.

Mason later added: “With the help of these latest contributions and the generous donations over the past few weeks, we‘ve been able to garner more than $10 million to provide aid for music people across all genres, crafts and disciplines affected by the coronavirus pandemic. That said, the need is still so great and these times remain critical for music people”.

Echoing Harvey’s comments, Steve Boom – Chair of MusiCares – thanked ASCAP, BMI, SESAC and others who have extended an arm to grow the fund. But also emphasized that more is needed.

Boom shared:“We’re thrilled to see the continued support from organizations to help all the people who were depending on their next gig to make ends meet. There is still much more work to be done, and we hope that those who have supported us will continue to inspire others to do what’s needed for the music industry during this unprecedented time”.

BMI’s President, Mike O’Neil, said the company was ‘grateful’ to be able to join in with ASCAP and SESAC in being a help to the community of music creators during this time.

O’Neil closed by saying: “The creative community is resilient and will continue to inspire the industry as we get through this together”.

Elizabeth Matthews (Chief Executive of ASCAP) and John Josephson (SESAC Chairman/CEO) also acknowledged and thank each of the other two PROs – with the latter noting that “It is essential that we do all we can to make sure that our creators have the resources they need to navigate this crisis and continue practicing their craft”.

In addition to opening the MusiCares COVID-19 Relief Fund, The Recording Academy has made an appeal to Congress for further assistance for affected workers in the music industry. Local Chapters of the organization are also raising funds to help those within their respective regions.

Get weekly music biz updates straight to your inbox.

MBN Staff

Analysis

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

MBN Exclusive: New Soundcharts Data Shows The Cogs Working Behind Rap’s Hottest War.

Published

2 months agoon

Thursday, 6 June 2024 @ 20:51 EDT

Story Highlights

New data provides unprecedented insight into the underlying methodology of the Drake-Kendrick feud crucial to understanding the broader battle for hip-hop supremacy.

Few rivalries in the high-stakes world of hip hop superstardom have captured the cultural zeitgeist as completely as the recent feud between ‘Rap Gods’ Drake and Kendrick Lamar. Being two of the genre’s OGs, their every move sent reverberations through the music industry and beyond. A lot of the conversation around the ‘slugfest’ revolved around the surface-level spectacle of the diss tracks and opinions among fans, but the real narrative that shapes this feud is the one presented in the data (the streaming numbers, radio spins and listener trends that provide an insight into the way the two superstars’ strategies prior to the ‘war of words’ helped them to navigate this war behind the scenes.

A Geographic Dividend

As we previously reported at Music Biz Nation, data from Luminate – a premier music analytics company – showed an slight difference in how Drake and Kendrick diss tracks were being consumed regionally versus internationally in comparison to their overall catalogs. In Kendrick’s case, American listeners were responsible for 62.2% of streams on his Drake diss tracks, 11.5% above his typical 50.7% U.S. share. Meanwhile, Drake saw only a small boost in U.S. streams for his Kendrick disses, bumping from 58.9% to 60.1% – with the remainder coming from international markets.

Getting more specific, Kendrick’s top listenership on Spotify stems from Los Angeles (also his top radio market), London and Chicago (all seeing a 2-3% monthly increase in the past month). Drake still comfortably maintained an 82.5 million to Kendrick’s 78 million in Spotify monthly listeners over the past 28 days, with his top markets on the platform being London, Los Angeles, and New York. Notably, Drake saw a 1-2% dip in listenership in all three of his top markets, while Kendrick gained ground in each of them.

The Streaming Showdown: Loyalty vs. Virality

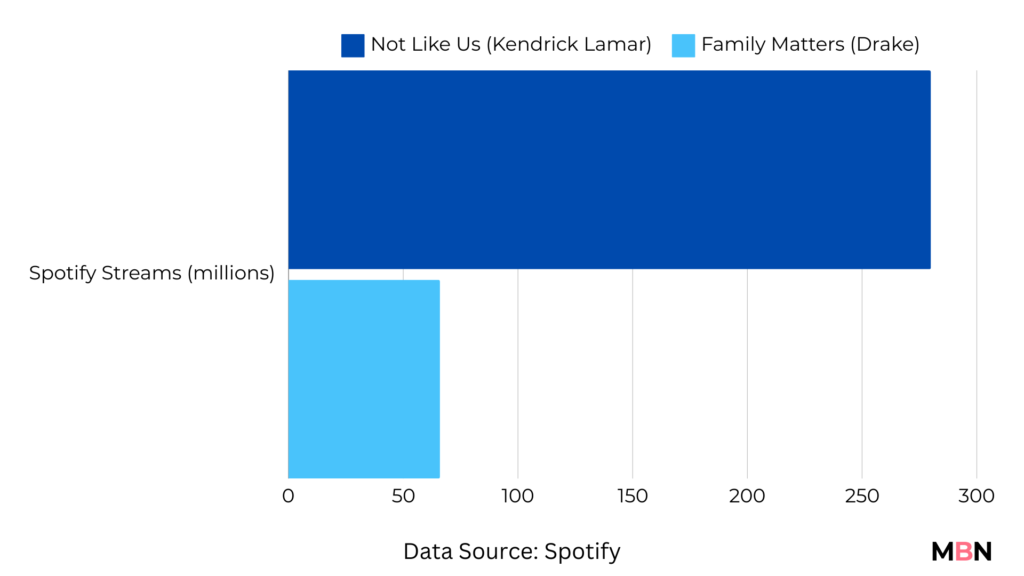

In the wake of Kendrick’s numerous diss tracks, including the most popular of them all “Not Like Us,” (amassing 280 million streams and 2,000+ playlist placements on Spotify alone) his monthly Spotify listener count surged by an impressive 27 million. Drake, meanwhile, saw a comparatively modest dip of 1.5 million monthly listeners since the start of the feud, with his most popular Kendrick-diss “Family Matters” totaling a mere 66 million Spotify streams and 700 playlists on the platform. On the surface, this might suggest a clear win for Kendrick. However, a deeper dive into listener retention rates tells a more complex story.

Drake’s retention rate actually increased from 105% to 109% during this period, indicating that his core fanbase remains remarkably steadfast in their loyalty, even in the face of Kendrick’s onslaught. Additionally, Drake’s monthly listener count on Spotify, even after a 1.5 million dip, still towers over Kendrick’s but only slightly at 82.5 million to 78 million – a much closer gap than before the ‘war’.

Kendrick, on the other hand, saw his retention rate plummet from 43% to 38%, suggesting that many of his newly-gained listeners may be more curious onlookers than devoted fans.

This data paints a picture of two contrasting strategies – one focused on cultivating deep, lasting loyalty, the other on generating viral moments and sparking widespread curiosity. While Kendrick’s approach may be winning the battle for short-term attention, Drake’s strategy could prove more effective in the long-term war for enduring dominance.

Kendrick’s cultural references in his diss tracks is likely what ignited and engaged more of his U.S. audience. Meanwhile, the strength of his overall catalog has allowed Drake to rely on his status as a global superstar, betting on the continued reliability of his massive global audience to absorb any blowback.

Radio Waves Shift: Kendrick's Domestic Surge

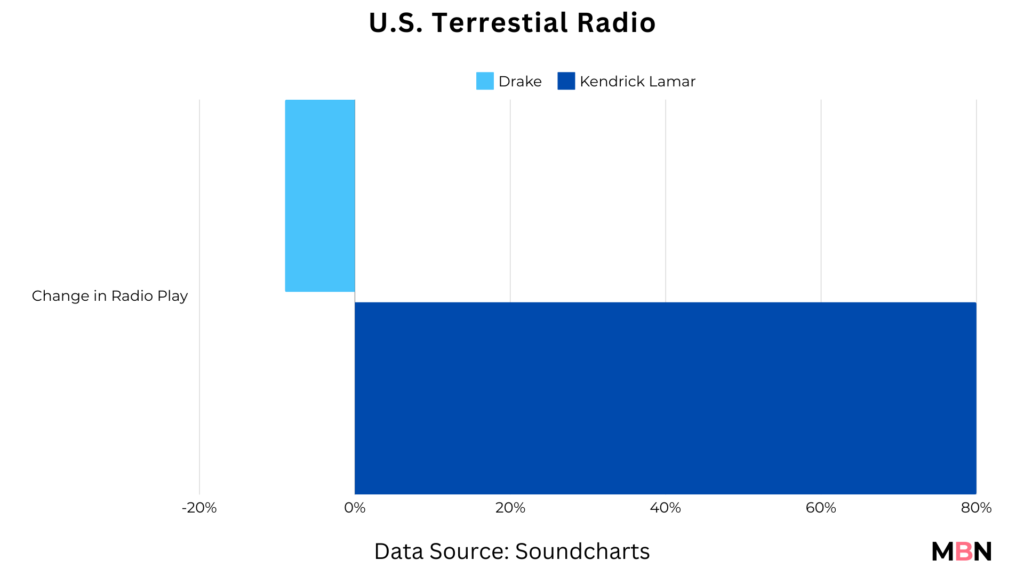

Soundcharts data also point to a change in radio play dynamics over the last month. While Drake’s radio spins dipped slightly in the U.S. (-9%) and U.K. (-6%) – two of his top markets – Kendrick Lamar has seen an 80% increase in U.S. radio play in the wake of feud. Lamar’s increased radio play in the U.S. was, unsurprisingly, driven by airplay of “Not Like Us” in the Los Angeles area (his home county) on stations such as Power106 and KRRL-FM Real 92.3 (responsible for Kendrick’s highest number of global radio plays over the last month).

Most tellingly, but somewhat expected, the LA-based Real 92.3, the station that has been Kendrick’s staunchest cheerleader, cut Drake’s airplay by a staggering 30% during the month of May.

This domestic dominant radio surge for Kendrick, coupled with the increase in U.S. streaming share for his diss tracks might speak to the effectiveness of his regionally-focused strategy in comparison to Drake’s. And with the U.S. being the biggest market for the Hip Hop genre, it is not difficult to see why a strategy like this has created such an impact in his battle with the Toronto-based rapper.

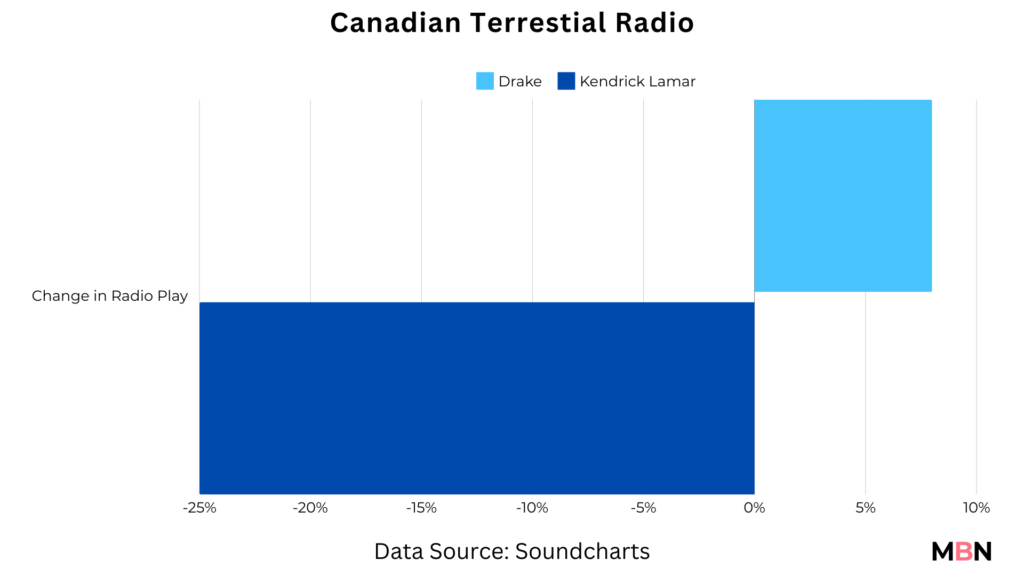

In Drake’s case, despite facing slight challenges in the U.S. radio market during the feud, the ‘6 God’ has managed to maintain his global radio dominance by making up ground key local and international markets in regions such as France (up 12%) and his home country of Canada (up 8%), where Kendrick has seen a 25% decline in airplay.

In saying that, like Drake, Kendrick has also compensated by making significant progress in other international radio markets over the past month – such as Nigeria (+104% in spins) and portions of Europe (U.K. +40%, Belgium +27%, Germany +26%, ).

Kendrick's Viral Breakthrough: The TikTok Wildcard

Where Drake may be ahead in terms of the raw numbers of streams and spins of his overall catalog, when it comes to the virality of this feud, Kendrick has taken the crown by more than a mile.

In just one month after its release, “Not Like Us” was the soundtrack for 560,000+ TikTok videos and 1.4 billion views, quickly becoming his third most popular song on the platform as lead artist (surpassing “We Cry Together”, from his most recent album ‘Mr. Morale & The Big Steppers’). The uptick is arguably a testament to Kendrick’s ‘hidden’ ability to create a moment that lands with TikTok’s wide audience often moved by the winds of popularity – something Drake was more known for excelling at prior to the feud. Drizzy’s most popular TikTok song “Tootsie Slide” has amassed 2.8 million videos and 8.2 billion views, compared to Kendrick’s 1.1 million videos and 1.3 billion videos for his most popular TikTok song “HUMBLE”. Notably, “Not Like Us” has accumulated more TikTok views than “HUMBLE.” with half the number of videos, speaking to its undeniable cultural impact.

Drake’s most popular song in the ‘back and forth’ with Lamar, “Family Matters”, stands at just 1,800 TikTok videos and 7.5 million views.

In an era where a single viral moment can redefine an artist’s trajectory, Kendrick’s overwhelming TikTok triumph in this feud could be an extremely powerful weapon in his arsenal. If he can sustain this momentum and translate the buzz into lasting listener growth and engagement, it could dramatically redefine of his overall positioning. Should the feud continue in any way, this is a wildcard that Drake (despite his overall dominance) cannot afford to ignore.

Looking Ahead...

With all that said, one thing is clear: the Drake-Kendrick beef was much more than a rap beef. As the reams of data show, it’s a rich, multifaceted playbook for how different strategies can determine equally impactful yet completely different outcomes. Every artist has their own unique arsenal of strengths and strategies — Drake’s unbreakable global grip and resistance to wobble in the storm, Kendrick’s gift for the viral moment and local relevance — which we’ll continue to watch with his future releases.

Get weekly music biz updates straight to your inbox.

MBN Staff

Entertainment

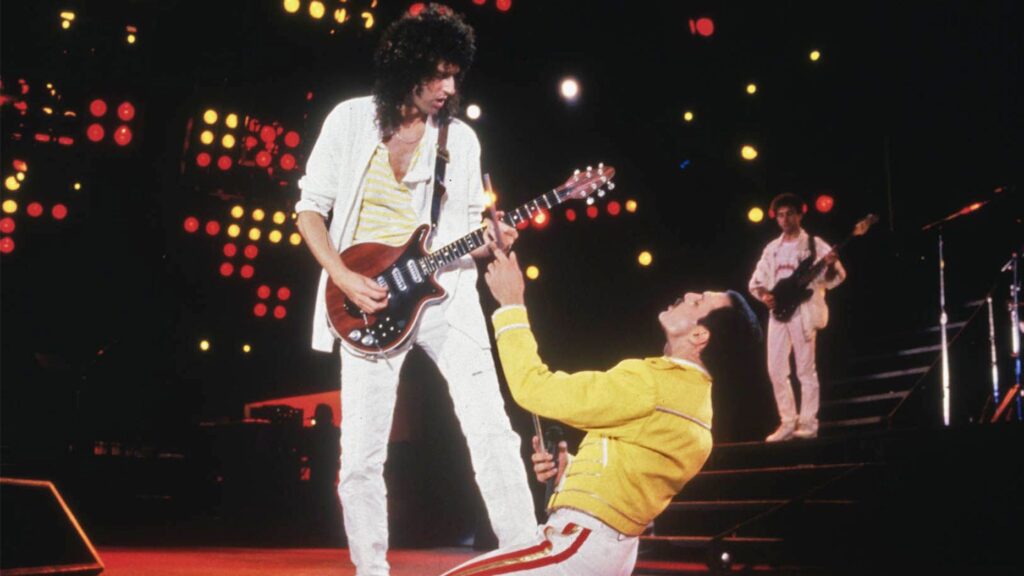

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Source says discussions between Queen and Sony Music over the British band’s catalog sale have been ongoing since last year.

Published

2 months agoon

Thursday, 30 May 2024 @ 13:46 EDT

Story Highlights

Sony’s potential deal for Queen’s music assets could make it the biggest single-artist catalog acquisition in history.

According to multiple outlets, sources report that iconic British rock band Queen has been seeking a valuation of around $1.2 billion for its music assets, which consist of both publishing and master recording rights jointly owned by the band’s surviving members Brian May, Roger Taylor and John Deacon, as well as the Freddie Mercury estate. Bloomberg first reported that Sony Music is the undisclosed suitor currently in an exclusive negotiating window with Queen, working with an unnamed financial partner.

Music Business Worldwide originally broke news of the catalog being shopped for a 9-figure sum in May 2023, noting that major labels like Universal Music Group and private equity players had engaged in discussions.

Of course, putting together a deal of this magnitude and complexity, especially with multiple stakeholders involved, comes with no guarantee of closer. As a cautionary example, sources say Pink Floyd’s attempt to sell their catalog for $500 million collapsed in 2022 due to band members having differing priorities.

Inside Queen's Financial Performance

Music Business Worldwide also reported that Queen Productions Ltd, the UK entity housing the band’s recordings, reported £40.89 million ($50.41m) in turnover for the fiscal year ending September 2022, a 4.3% increase over 2021. Profit before taxes jumped 31.6% to £22.16 million ($27.41m).

Much of this growth likely stems from the popularity boost following the band’s 2018 biopic Bohemian Rhapsody. In fact, the FY2022 revenue figure more than tripled Queen’s £12.34 million turnover ($16.72m) in FY2016 before the film’s release. The band’s enduring appeal is further evidenced by the nearly 38 million album consumption units and 46 billion on-demand global streams their catalog has amassed since 1991, according to Luminate and reported by Billboard.

Implications of a Billion-Dollar Sale

If completed in the $1 billion range as reported, Queen’s sale would handily surpass Bruce Springsteen’s $500 million+ catalog deal with Sony in 2021 to become the biggest transaction for a single artist’s body of work. It would also dwarf the $600 million Sony allegedly paid in February for 50% of Michael Jackson’s catalog. Though, technically speaking, with only the remaining 50% sold, the deal with the Jackson estate valued the late King of Pop’s catalog at $1.2 billion – slightly above than the reported $1 billion offer of Queen’s work, if that number is exact.

However, Queen’s situation is a little more complicated due to Disney Music Group’s current rights to their master recordings in North America under the Hollywood Records umbrella. Any acquirer would need to navigate that structure and DMG’s global distribution pact with Universal.

The stratospheric valuations attached to evergreen hit songs have enticed artists to cash in on their life’s work, accepting a one-time capital gains tax rather than annual income taxes on royalties. But as the Hipgnosis Songs Fund has demonstrated, aggregating catalogs at premium prices fueled by cheap debt doesn’t automatically translate into strong returns. Blackstone’s takeover of Hipgnosis following a shareholder revolt underscores the potential risks of catalog acquisition sprees.

Queen, though, stands apart as one of the most commercially successful acts in history, notching six No. 1 singles and 10 No. 1 albums in the UK across five decades. With the right promotion and synch opportunities, dozens of their songs like “Bohemian Rhapsody,” “We Will Rock You,” and “Another One Bites the Dust” have the potential to generate substantial returns for decades to come. But at a $1 billion entry price, Sony or any other buyer will need to be confident they can unlock significantly more value to make the numbers work.

Get weekly music biz updates straight to your inbox.

MBN Staff

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Albums Chart Data: Swift & Eilish Dominate UK & US Listings