News

Global Indie Body WIN Publishes AI Principles for the Music Industry

The Worldwide Independent Network’s guidance covers key areas such as copyright, human-centered approach, transparency, and ethical development.

Published

2 years agoon

Story Highlights

WIN is urging developers and policymakers to create a responsible, ethical licensing marketplace.

The rapid advancement of generative AI technologies continue to spark conversations across the music industry about both the potential opportunities and challenges it presents. As a response, the Worldwide Independent Network (WIN) – the global body representing the independent music community – has released a set of principles to guide the development of AI in the music sector.

The principles, which are the result of extensive consultation with WIN’s global membership, cover five key areas:

- Respect for copyright: The use of music and related content to train AI models should be subject to copyright and requires explicit permission in advance, including fair and appropriate remuneration for creators.

- Prioritizing a human-centered approach: WIN believes that content generated by AI without human creativity should not qualify for copyright protection.

- Safety: The principles emphasize the importance of protecting creators, fans, consumers, and the public from potential harms associated with AI technologies.

- Fundamental transparency: AI-generated content should be properly labeled, and transparency should be built in at all stages of AI development, including record-keeping of training datasets.

- Ethical development through collaboration: WIN calls for developers and policymakers to engage with the music community to ensure responsible and ethical AI development that benefits all participants.

With these principles provided as a compass, we look forward to collaborating with responsible AI developers and inspiring policymakers around the world.

Noemí Planas, WIN

A Responsible Licensing Marketplace

Central to WIN’s principles is the idea of creating a licensing marketplace for AI training that fairly compensates creators and rightsholders. This follows recent moves by major music companies, such as Sony Music’s letter to AI developers asserting the label’s legal right to opt out of having its intellectual property used for training AI models.

WIN CEO Noemí Planas emphasized the independent community’s openness to technological developments that respect the value of music and creators’ rights, stating: “With these principles provided as a compass, we look forward to collaborating with responsible AI developers and inspiring policymakers around the world.”

The Challenges and Opportunities

The music industry’s approach to AI is multifaceted, with companies exploring potential benefits such as AI-assisted music creation tools (such as Google’s recently announced AI Sandbox), while also grappling with issues like deepfakes and unauthorized use of copyrighted material.

As noted by AIM Interim CEO Gee Davy, the global independent music community believes in leadership through knowledge-sharing and inclusive discussion. Like other industry bodies and corporations, WIN’s principles surrounding AI ultimately aim to provide a foundation for meaningful collaboration that supports human artistry and innovation while creating a successful, creative future for AI in music.

Moving forward, the ongoing dialogue between music industry stakeholders, AI developers, and policymakers will be crucial in shaping the future of AI in the music sector.

With its new set of guiding principles, WIN has clearly communicated the independent community’s stance, expectations and priorities, setting the stage for a more responsible, ethical approach to AI development that respects the rights and interests of creators and fans alike.

Get weekly music biz updates straight to your inbox.

MBN Staff

Analysis

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

MBN Exclusive: New Soundcharts Data Shows The Cogs Working Behind Rap’s Hottest War.

Published

2 years agoon

Thursday, 6 June 2024 @ 20:51 EDT

Story Highlights

New data provides unprecedented insight into the underlying methodology of the Drake-Kendrick feud crucial to understanding the broader battle for hip-hop supremacy.

Few rivalries in the high-stakes world of hip hop superstardom have captured the cultural zeitgeist as completely as the recent feud between ‘Rap Gods’ Drake and Kendrick Lamar. Being two of the genre’s OGs, their every move sent reverberations through the music industry and beyond. A lot of the conversation around the ‘slugfest’ revolved around the surface-level spectacle of the diss tracks and opinions among fans, but the real narrative that shapes this feud is the one presented in the data (the streaming numbers, radio spins and listener trends that provide an insight into the way the two superstars’ strategies prior to the ‘war of words’ helped them to navigate this war behind the scenes.

A Geographic Dividend

As we previously reported at Music Biz Nation, data from Luminate – a premier music analytics company – showed an slight difference in how Drake and Kendrick diss tracks were being consumed regionally versus internationally in comparison to their overall catalogs. In Kendrick’s case, American listeners were responsible for 62.2% of streams on his Drake diss tracks, 11.5% above his typical 50.7% U.S. share. Meanwhile, Drake saw only a small boost in U.S. streams for his Kendrick disses, bumping from 58.9% to 60.1% – with the remainder coming from international markets.

Getting more specific, Kendrick’s top listenership on Spotify stems from Los Angeles (also his top radio market), London and Chicago (all seeing a 2-3% monthly increase in the past month). Drake still comfortably maintained an 82.5 million to Kendrick’s 78 million in Spotify monthly listeners over the past 28 days, with his top markets on the platform being London, Los Angeles, and New York. Notably, Drake saw a 1-2% dip in listenership in all three of his top markets, while Kendrick gained ground in each of them.

The Streaming Showdown: Loyalty vs. Virality

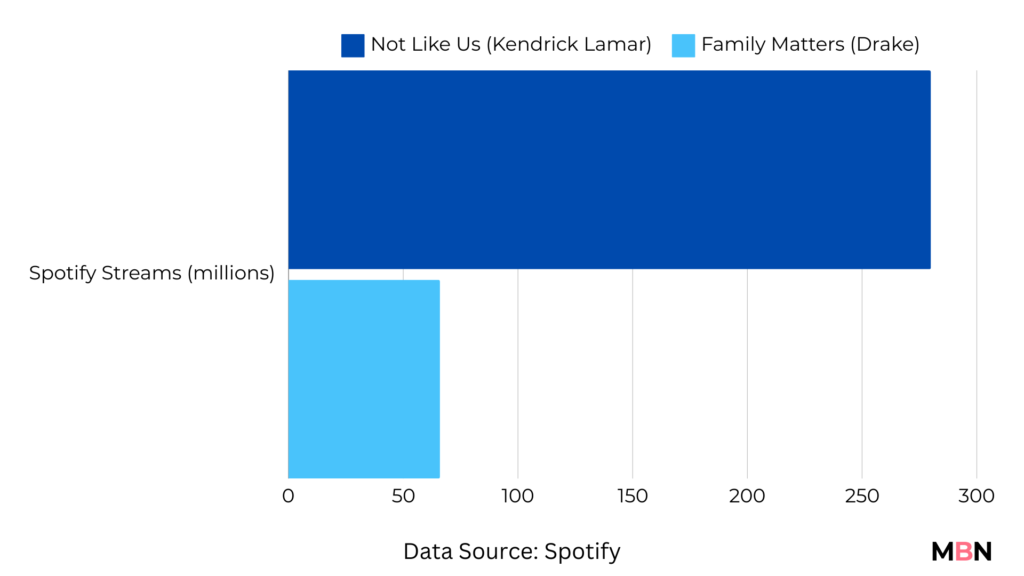

In the wake of Kendrick’s numerous diss tracks, including the most popular of them all “Not Like Us,” (amassing 280 million streams and 2,000+ playlist placements on Spotify alone) his monthly Spotify listener count surged by an impressive 27 million. Drake, meanwhile, saw a comparatively modest dip of 1.5 million monthly listeners since the start of the feud, with his most popular Kendrick-diss “Family Matters” totaling a mere 66 million Spotify streams and 700 playlists on the platform. On the surface, this might suggest a clear win for Kendrick. However, a deeper dive into listener retention rates tells a more complex story.

Drake’s retention rate actually increased from 105% to 109% during this period, indicating that his core fanbase remains remarkably steadfast in their loyalty, even in the face of Kendrick’s onslaught. Additionally, Drake’s monthly listener count on Spotify, even after a 1.5 million dip, still towers over Kendrick’s but only slightly at 82.5 million to 78 million – a much closer gap than before the ‘war’.

Kendrick, on the other hand, saw his retention rate plummet from 43% to 38%, suggesting that many of his newly-gained listeners may be more curious onlookers than devoted fans.

This data paints a picture of two contrasting strategies – one focused on cultivating deep, lasting loyalty, the other on generating viral moments and sparking widespread curiosity. While Kendrick’s approach may be winning the battle for short-term attention, Drake’s strategy could prove more effective in the long-term war for enduring dominance.

Kendrick’s cultural references in his diss tracks is likely what ignited and engaged more of his U.S. audience. Meanwhile, the strength of his overall catalog has allowed Drake to rely on his status as a global superstar, betting on the continued reliability of his massive global audience to absorb any blowback.

Radio Waves Shift: Kendrick's Domestic Surge

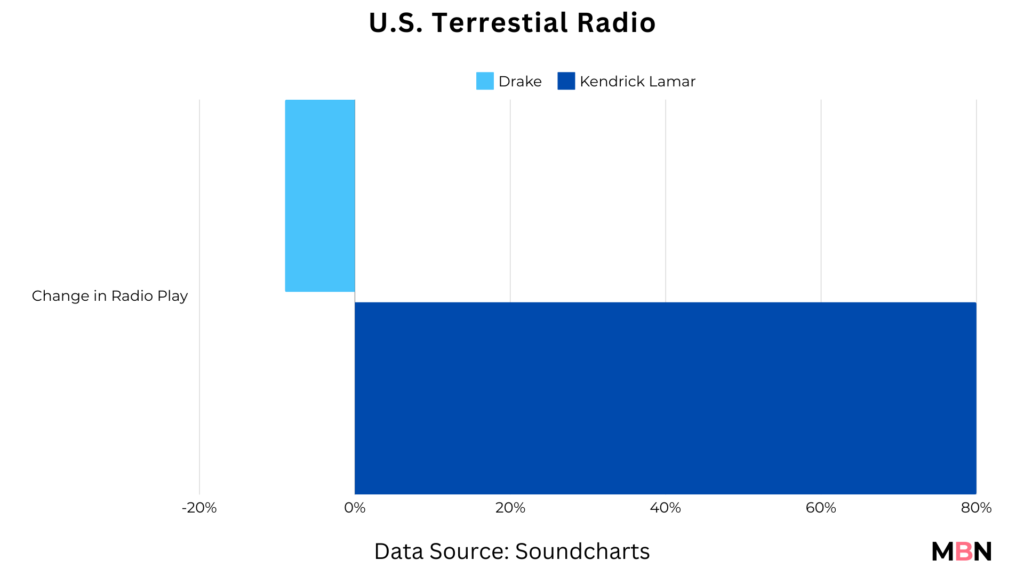

Soundcharts data also point to a change in radio play dynamics over the last month. While Drake’s radio spins dipped slightly in the U.S. (-9%) and U.K. (-6%) – two of his top markets – Kendrick Lamar has seen an 80% increase in U.S. radio play in the wake of feud. Lamar’s increased radio play in the U.S. was, unsurprisingly, driven by airplay of “Not Like Us” in the Los Angeles area (his home county) on stations such as Power106 and KRRL-FM Real 92.3 (responsible for Kendrick’s highest number of global radio plays over the last month).

Most tellingly, but somewhat expected, the LA-based Real 92.3, the station that has been Kendrick’s staunchest cheerleader, cut Drake’s airplay by a staggering 30% during the month of May.

This domestic dominant radio surge for Kendrick, coupled with the increase in U.S. streaming share for his diss tracks might speak to the effectiveness of his regionally-focused strategy in comparison to Drake’s. And with the U.S. being the biggest market for the Hip Hop genre, it is not difficult to see why a strategy like this has created such an impact in his battle with the Toronto-based rapper.

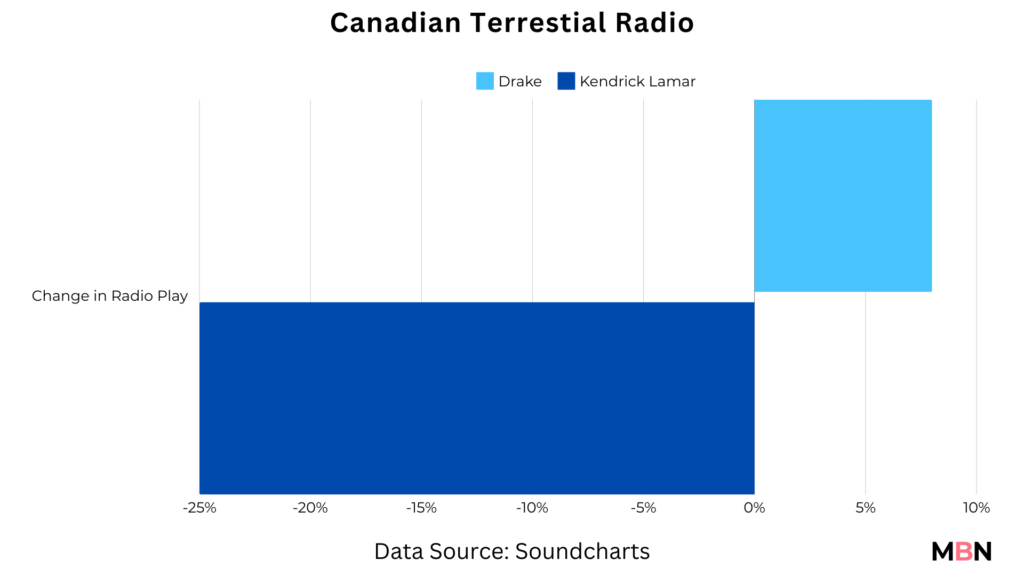

In Drake’s case, despite facing slight challenges in the U.S. radio market during the feud, the ‘6 God’ has managed to maintain his global radio dominance by making up ground key local and international markets in regions such as France (up 12%) and his home country of Canada (up 8%), where Kendrick has seen a 25% decline in airplay.

In saying that, like Drake, Kendrick has also compensated by making significant progress in other international radio markets over the past month – such as Nigeria (+104% in spins) and portions of Europe (U.K. +40%, Belgium +27%, Germany +26%, ).

Kendrick's Viral Breakthrough: The TikTok Wildcard

Where Drake may be ahead in terms of the raw numbers of streams and spins of his overall catalog, when it comes to the virality of this feud, Kendrick has taken the crown by more than a mile.

In just one month after its release, “Not Like Us” was the soundtrack for 560,000+ TikTok videos and 1.4 billion views, quickly becoming his third most popular song on the platform as lead artist (surpassing “We Cry Together”, from his most recent album ‘Mr. Morale & The Big Steppers’). The uptick is arguably a testament to Kendrick’s ‘hidden’ ability to create a moment that lands with TikTok’s wide audience often moved by the winds of popularity – something Drake was more known for excelling at prior to the feud. Drizzy’s most popular TikTok song “Tootsie Slide” has amassed 2.8 million videos and 8.2 billion views, compared to Kendrick’s 1.1 million videos and 1.3 billion videos for his most popular TikTok song “HUMBLE”. Notably, “Not Like Us” has accumulated more TikTok views than “HUMBLE.” with half the number of videos, speaking to its undeniable cultural impact.

Drake’s most popular song in the ‘back and forth’ with Lamar, “Family Matters”, stands at just 1,800 TikTok videos and 7.5 million views.

In an era where a single viral moment can redefine an artist’s trajectory, Kendrick’s overwhelming TikTok triumph in this feud could be an extremely powerful weapon in his arsenal. If he can sustain this momentum and translate the buzz into lasting listener growth and engagement, it could dramatically redefine of his overall positioning. Should the feud continue in any way, this is a wildcard that Drake (despite his overall dominance) cannot afford to ignore.

Looking Ahead...

With all that said, one thing is clear: the Drake-Kendrick beef was much more than a rap beef. As the reams of data show, it’s a rich, multifaceted playbook for how different strategies can determine equally impactful yet completely different outcomes. Every artist has their own unique arsenal of strengths and strategies — Drake’s unbreakable global grip and resistance to wobble in the storm, Kendrick’s gift for the viral moment and local relevance — which we’ll continue to watch with his future releases.

Get weekly music biz updates straight to your inbox.

MBN Staff

Entertainment

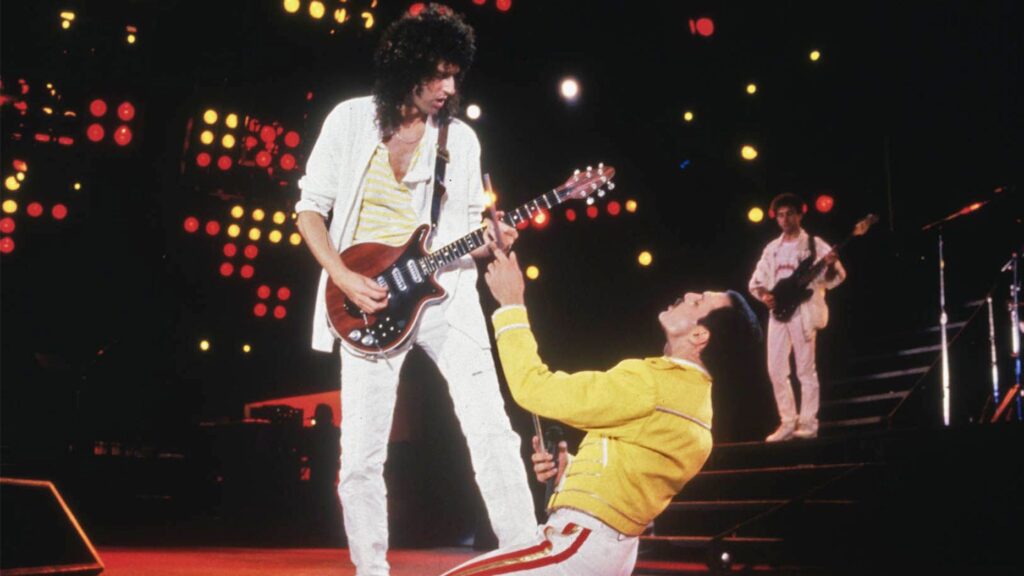

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Source says discussions between Queen and Sony Music over the British band’s catalog sale have been ongoing since last year.

Published

2 years agoon

Thursday, 30 May 2024 @ 13:46 EDT

Story Highlights

Sony’s potential deal for Queen’s music assets could make it the biggest single-artist catalog acquisition in history.

According to multiple outlets, sources report that iconic British rock band Queen has been seeking a valuation of around $1.2 billion for its music assets, which consist of both publishing and master recording rights jointly owned by the band’s surviving members Brian May, Roger Taylor and John Deacon, as well as the Freddie Mercury estate. Bloomberg first reported that Sony Music is the undisclosed suitor currently in an exclusive negotiating window with Queen, working with an unnamed financial partner.

Music Business Worldwide originally broke news of the catalog being shopped for a 9-figure sum in May 2023, noting that major labels like Universal Music Group and private equity players had engaged in discussions.

Of course, putting together a deal of this magnitude and complexity, especially with multiple stakeholders involved, comes with no guarantee of closer. As a cautionary example, sources say Pink Floyd’s attempt to sell their catalog for $500 million collapsed in 2022 due to band members having differing priorities.

Inside Queen's Financial Performance

Music Business Worldwide also reported that Queen Productions Ltd, the UK entity housing the band’s recordings, reported £40.89 million ($50.41m) in turnover for the fiscal year ending September 2022, a 4.3% increase over 2021. Profit before taxes jumped 31.6% to £22.16 million ($27.41m).

Much of this growth likely stems from the popularity boost following the band’s 2018 biopic Bohemian Rhapsody. In fact, the FY2022 revenue figure more than tripled Queen’s £12.34 million turnover ($16.72m) in FY2016 before the film’s release. The band’s enduring appeal is further evidenced by the nearly 38 million album consumption units and 46 billion on-demand global streams their catalog has amassed since 1991, according to Luminate and reported by Billboard.

Implications of a Billion-Dollar Sale

If completed in the $1 billion range as reported, Queen’s sale would handily surpass Bruce Springsteen’s $500 million+ catalog deal with Sony in 2021 to become the biggest transaction for a single artist’s body of work. It would also dwarf the $600 million Sony allegedly paid in February for 50% of Michael Jackson’s catalog. Though, technically speaking, with only the remaining 50% sold, the deal with the Jackson estate valued the late King of Pop’s catalog at $1.2 billion – slightly above than the reported $1 billion offer of Queen’s work, if that number is exact.

However, Queen’s situation is a little more complicated due to Disney Music Group’s current rights to their master recordings in North America under the Hollywood Records umbrella. Any acquirer would need to navigate that structure and DMG’s global distribution pact with Universal.

The stratospheric valuations attached to evergreen hit songs have enticed artists to cash in on their life’s work, accepting a one-time capital gains tax rather than annual income taxes on royalties. But as the Hipgnosis Songs Fund has demonstrated, aggregating catalogs at premium prices fueled by cheap debt doesn’t automatically translate into strong returns. Blackstone’s takeover of Hipgnosis following a shareholder revolt underscores the potential risks of catalog acquisition sprees.

Queen, though, stands apart as one of the most commercially successful acts in history, notching six No. 1 singles and 10 No. 1 albums in the UK across five decades. With the right promotion and synch opportunities, dozens of their songs like “Bohemian Rhapsody,” “We Will Rock You,” and “Another One Bites the Dust” have the potential to generate substantial returns for decades to come. But at a $1 billion entry price, Sony or any other buyer will need to be confident they can unlock significantly more value to make the numbers work.

Get weekly music biz updates straight to your inbox.

MBN Staff

Canada Slashes Kendrick Lamar’s Radio Play By 25%, While Drake Sees a 10% Decline In The U.S.

Sony Reportedly in Talks for $1 Billion Queen Catalog Acquisition

Drake vs. Kendrick: How Their Diss Track Data Reveals Divergent Paths to Streaming Dominance

Albums Chart Data: Swift & Eilish Dominate UK & US Listings